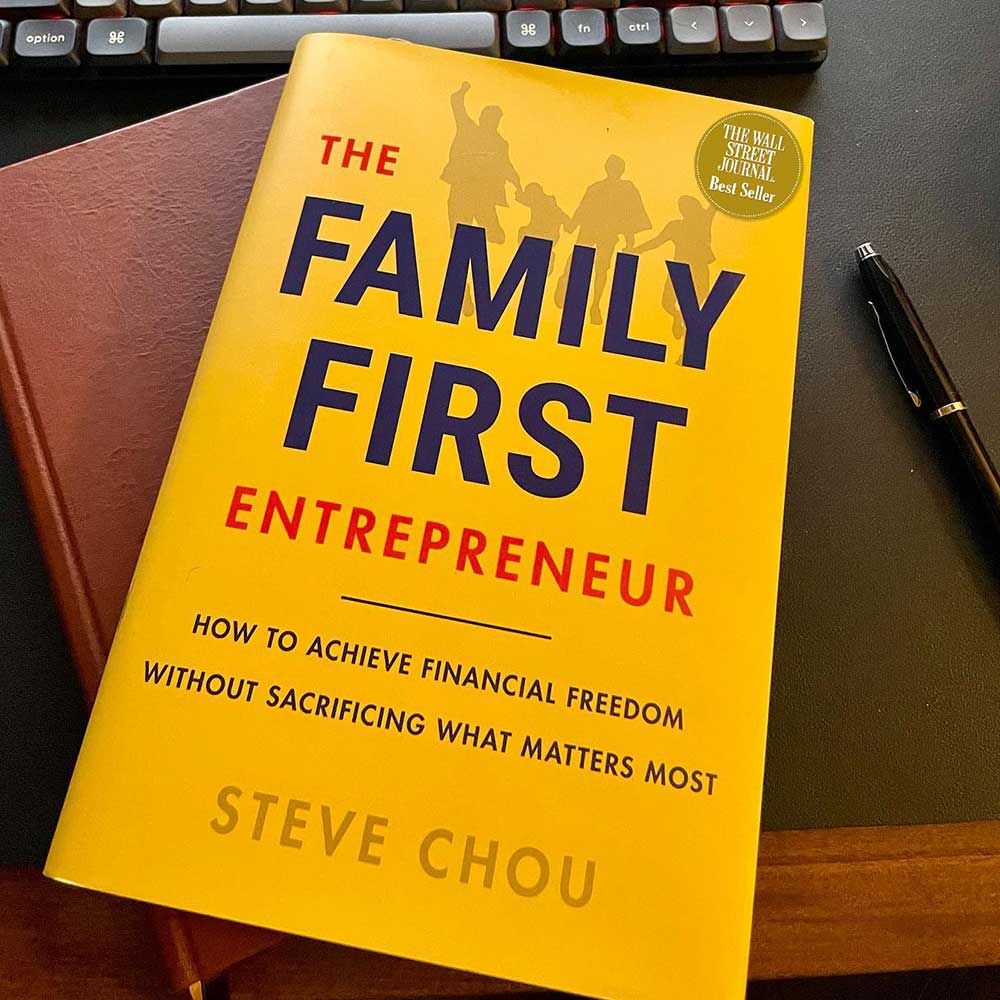

This book will show you how to reclaim your time by being your own boss. Time...that you can use to pursue your passions or to spend more time with your loved ones.

The Family First Entrepreneur will teach you a sustainable way to achieve financial freedom from the perspective of a father who makes both business and family work.

As Seen In

Explore The Site

Learn How To Start An Online Store

We have put together a free comprehensive guide on how to open your own online store.

Learn How To Sell On Amazon

Browse our comprehensive resource guide on how to make money selling on Amazon.

Discover The Business Products I Recommend

The products and services that I use for my online store every single day. Highly recommended!

Visit My Kids' Online T-Shirt Store

Check out the online business I started with my kids selling entrepreneurial t-shirts!