If you are looking to accept credit cards for your online store, you are probably considering one of the big three, Paypal, Authorize.net and Stripe.

But the problem with choosing between these payment options is that all 3 services look similar on the surface.

One, they all offer the same introductory rates with a transaction fee of 2.9% + $.30. And two, they all claim to provide a “robust integration with leading shopping cart providers” for all sized businesses.

In fact, if you look at the sales pages for all 3 services, they all read pretty much the same with the exception that Stripe doesn’t charge a monthly fee.

But here’s the thing.

Once your store has some decent transaction volume, the transaction rates change dramatically and none of these rates are documented anywhere. In fact, you often have to negotiate the rates yourself.

To further muddy the waters, services like Paypal often have multiple options to choose from which all behave differently.

So today, I’m going to explain in plain language what sets these 3 payment processors apart from each other.

In addition, I’ll tell you what rates that I’ve been able to negotiate with each of these services and where the cut off points are.

Get My Free Mini Course On How To Start A Successful Ecommerce Store

If you are interested in starting an ecommerce business, I put together a comprehensive package of resources that will help you launch your own online store from complete scratch. Be sure to grab it before you leave!

The Difference Between Paypal Standard, Paypal Checkout, Paypal Advanced And Paypal Payments Pro

Right now, Paypal now offers 4 different choices to accept credit cards on your site.

- Paypal Standard – Free for all merchants

- Paypal Checkout – Free for all merchants

- Paypal Advanced – $5/month

- Paypal Payments Pro – $30/month

Unfortunately, it’s not very intuitive which one you should choose and what the advantages are for each. Therefore, I’m going to start by summarizing Paypal’s 4 offerings below.

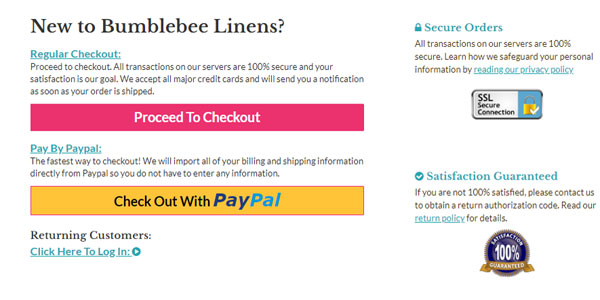

Paypal Standard

Paypal standard is completely free of charge and allows you to accept both credit cards and Paypal with your online store. However, there are 2 main disadvantages with Paypal Standard.

For one thing, Paypal Standard does not allow a customer to complete checkout on your website. Instead a customer is whisked away to Paypal’s site where they will be heavily influenced to create a Paypal account to pay for their goods.

Because a customer must leave your website, a high rate of customers will abandon their purchase altogether.

And to make things worse, Paypal does not make it obvious how to pay by credit card once you make it onto their site.

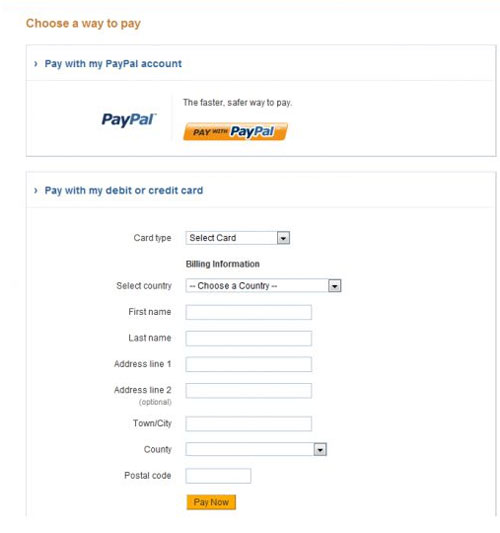

The picture above shows what a customer sees when they checkout using Paypal Standard. As you can tell, it’s not obvious how to pay by credit card.

You have to click on the “Don’t have a PayPal account” button in order to be directed to a form where you can enter your credit card info. Overall, I guarantee that you’ll shed many potential customers this way.

As a result, Paypal Standard is not a good credit card solution for an ecommerce store.

The only advantage is that it’s free.

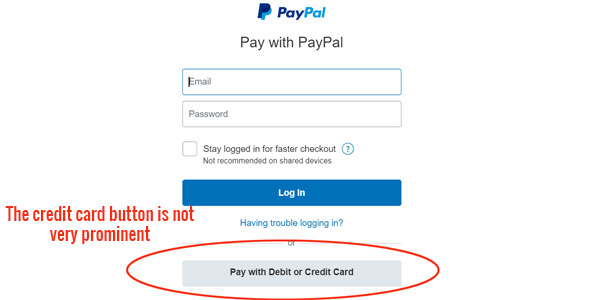

Paypal Checkout

Paypal Checkout is also completely free of charge and allows a customer to pay by credit card and Paypal. In fact, it is more or less identical to Paypal Standard except for one very important feature.

Paypal Checkout allows you to import a customer’s information directly into your shopping cart so they don’t have to fill out any forms.

Here’s what the flow looks like.

A customer is presented with the option to pay by Paypal Checkout.

When they click on the Paypal button, they are whisked off to Paypal’s website. Just like Paypal Standard, the option to pay by credit card is not very prominent.

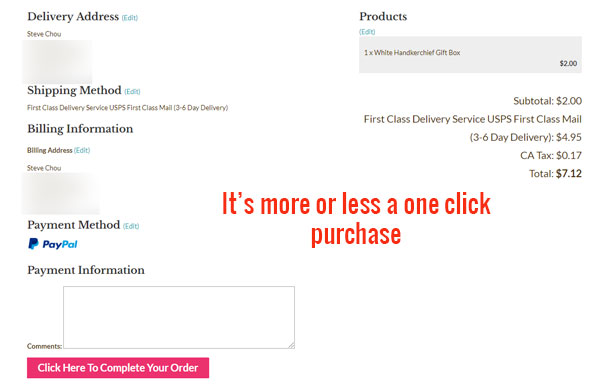

If a customer has a Paypal account, all of their address information on file at Paypal is magically imported into your shopping cart. They also have the option to store a cookie on their browser via Paypal One Touch so they never have to login to pay by Paypal again.

The following photo illustrates the Paypal Checkout flow on my online store after a customer logs in.

As you can see, the customer is just one click away from completing their purchase and no forms need to be filled out. In fact, this is the primary advantage of Paypal Checkout and it makes Paypal Standard obsolete.

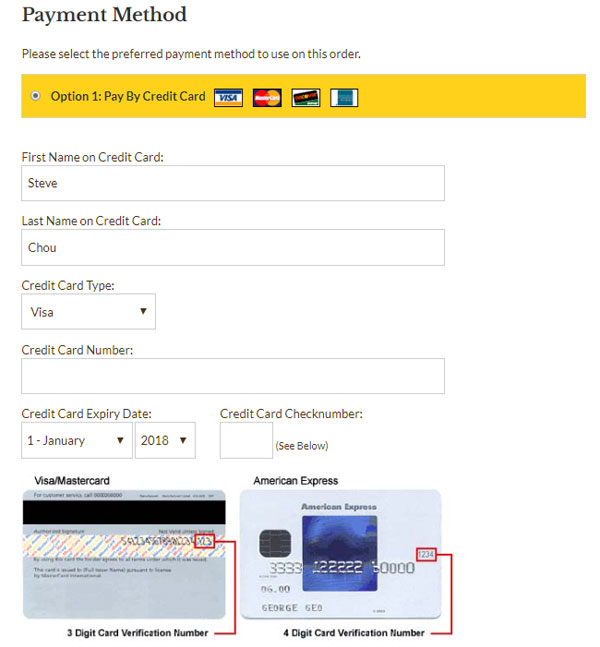

Paypal Payments Pro

On the other end of the spectrum, Paypal also offers a high end payment product called Payments Pro. With the pro version of Paypal, you can process credit cards directly on your site.

In addition, you have access to a virtual terminal in which you can process phone orders as well. Paypal Pro costs $30 per month and offers a complete solution to all of your credit card processing needs.

However the one big drawback is that since you are accepting credit cards on your own server, you must deal with PCI compliance.

What is PCI compliance?

PCI compliance is a set of standards enacted by the credit card community to ensure that all credit card transactions are secure.

In order for your online store to be PCI compliant, you must follow a set of guidelines in order to process credit cards on your website or face fines or penalties set forth by your credit card processor.

Honestly, becoming PCI compliant is not that big of a deal but the language used in the PCI compliance documentation is a nightmare to read and go through.

In fact, it’s like reading a law document. As a result, many new entrepreneurs are often confused and scared off by the whole process.

But nonetheless, if you use Paypal Pro on your online store, the payment transaction is seamless.

As you can see above, credit card processing is well blended with my website. To a customer, it appears as if everything is being processed natively in my shop.

Paypal Advanced

Paypal Advanced is a hybrid solution between Paypal Payments Pro and Paypal Standard/Checkout. Like Paypal Payments Pro, a customer can process their credit card payment online without leaving your website.

But unlike Paypal Payments Pro, the credit card information is not processed on your server but on Paypal’s instead. As a result with Paypal Advanced, you don’t have to worry about PCI compliance.

So how does it work? How can a customer still be on your website but not use your server to process and transmit their payment?

The answer is that Paypal Advanced uses iframes to process the payment.

If you are not technical, an iframe is basically a piece of your website that is hosted somewhere else. So when a customer is checking out from your online store, everything on your webpage will be hosted on your own website except for the credit card form fields.

Below is a screen shot of what the credit card form looks like as hosted on PayPal’s servers.

Everything you see in the box above can not be changed. However with some amount of work, you can often blend the box in with the rest of your website.

Paypal Advanced is not advertised by Paypal much at all and most people don’t know about it. But it costs just $5 per month.

Pros And Cons Of Paypal Advanced Vs Paypal Payments Pro Vs Paypal Checkout

Because a customer is taken off of your site, Paypal Checkout and Paypal Standard are not good solutions for accepting credit cards online.

As a result, your decision comes down to Paypal Pro or Paypal Advanced, both of which carry a monthly fee of $30 and $5 respectively.

But does it make sense to pay $30/month for Paypal Payments Pro when Paypal Advanced is only $5?

Here are some of the disadvantages of Paypal Advanced compared to Paypal Payments Pro.

- You can not customize the way the credit card form looks on your site. Because the credit card fields are hosted on Paypal’s servers, you pretty much have to tailor your checkout page around their credit card form to make it look good

- You do not have access to a virtual terminal – A virtual terminal allows you to process a credit card payment by hand which is useful when you take orders over the phone or when you have to conduct a special transaction

The biggest advantage of Paypal Advanced is the cost, the fact that you don’t have to worry about PCI compliance and the ability to process credit cards directly on your store without the customer having to leave your website.

Authorize.Net

Authorize.net is the traditional, old school credit card gateway solution that’s been around for decades. If you try to sign up for Authorize.net, you’ll find that there are many different vendors that will quote you wildly different rates.

In fact, it’s like shopping for insurance.

You have to find a provider that you like and then negotiate rates down based on your volume. If you are a brand new store, you’ll likely end up paying $30/month with a rate of 2.9%.

However once you achieve some decent transaction volume, you can push your rates down dramatically to a fixed rate above interchange. This transaction rate is otherwise known as Interchange Plus.

What is Interchange Plus?

The Interchange rate is the cost that your merchant account provider gets charged by VISA and MasterCard.

Interchange Plus means that your merchant account provider will pass through whatever they are getting charged by the interchange plus a markup for their services. This mark-up is charged on a per transaction basis as well as a percentage fee.

As a result, the Interchange Plus transaction rate tends to be much more steady and is in general lower than anything you can get with Paypal and Stripe.

Stripe

Stripe is probably the cheapest and easiest way to get started with your ecommerce store. It is supported by practically every ecommerce platform out there and it carries no monthly fee.

Not only that but you can often get approved in a matter minutes and start processing credit cards immediately!

The major downside to Stripe is that their rates are pretty much non-negotiable until you can consistently process at least $80K/month.

And even once you do achieve those levels, the negotiated rates are often on the order of 2.3% which is still higher than what you can get with Paypal and Authorize.net.

If You Process More Than 50K/Month – The Cheapest Solution Is…

First off, Stripe is never going to be the best deal unless you process a very low volume of $$$ per month. As a result, your best payment processing choice will be either Paypal Advanced, Paypal Pro or Authorize.net.

A typical Authorize.net merchant account and gateway will run you between 20-30 dollars a month. But the big advantage is that Authorize.net will give you a super low transaction rate.

For example, eMerchant, an Authorize.net credit card processor that I recommend, will allow you to process credit cards at a flat rate above interchange once you exceed $10k/month.

The exact rate depends on your volume but if you process over $50K/month, you can expect to pay anywhere between 2.0-2.3% on average in transaction fees for Visa and Mastercard.

The rates for accepting American Express are on the order of 2.5%. Debit cards are the lowest at around .5%.

The reason the rate is a range and not a fixed number is because different rewards cards get charged different rates on the interchange. (The exact reason why is beyond the scope of this post)

As for Paypal, your credit card processing rate at $50K/month would be a fixed 2.2% for Visa/Mastercard and 3.5% for American Express.

Let’s do some math shall we?

eMerchant charges a $30 monthly fee and let’s assume that you can get an average rate of 2.15% for Visa/Mastercard payments.

Paypal Advanced costs $5/month and the difference in monthly cost compared to eMerchant is $25.

Because the credit card processing rate differential is .05%, the breakeven point between Paypal Advanced and eMerchant is $50,000/month.

As a result, eMerchant will be cheaper than Paypal Advanced (and Paypal Pro) at volumes greater than $50,000/month.

However, there are some other factors to consider.

With Authorize.net, you have to get your server scanned on a quarterly basis for PCI compliance. Even though these scans are free, it’s still something extra that you’ll have to deal with.

If you accept a lot of American Express payments, Authorize.net will almost always be cheaper.

The same goes with Visa/Mastercard debit cards. While Paypal still charges 2.2% for a debit card, you will only pay .5% with Authorize.net.

If You Process Between 10K And 50K/Month – The Cheapest Solution Is…

At this volume Stripe is still going to be the most expensive solution since you can’t negotiate rates. As a result, your cheapest solution is either Paypal Advanced/Pro or Authorize.net.

However in the 10-50K/month processing range, the waters are a little murkier because it depends on your ability to negotiate.

Anecdotally, you can negotiate with Paypal on their credit card rates down to 2.2% as soon as you process over 10K/month.

Note: You can never negotiate with Paypal on Paypal processing rates. Only their credit card processing rates are negotiable. Unfortunately, Paypal payments are always a fixed 2.9% regardless of volume.

However with Authorize.net, it’s not as clear cut what you can get. At this volume, I’ve seen quotes from Authorize.net in the range of .4-.6% above interchange which works out to about 2.3%-2.5%.

Your mileage will vary but it implies that Paypal Advanced and Paypal Pro will be cheaper at this volume.

On the other hand, using Paypal has some major drawbacks which I outline in my article below.

Why Paypal Freezes Or Limits Accounts And How To Prevent This From Happening To You

But overall, both Paypal Advanced and Paypal Pro are great options once you process more than $10K/month.

If You Process Less Than 10K/Month – The Cheapest Solution Is…

At credit card processing volumes below 10K/month, your costs will be dominated largely by the fixed monthly processing fee. And because Stripe carries no monthly fees whatsoever, they will tend to be the cheapest.

As a result if you are a brand new ecommerce store, going with Stripe as your primary payment processor is a no brainer.

However, the waters get a little murkier once you start doing around $7500ish/month.

With Authorize.net and Paypal, you can sometimes negotiate the rates down to 2.5% after you exceed $5k in volume.

Now if you do the math, your break even point equation is simply (your monthly fee) / (2.9%-2.5%)

With Paypal Advanced, your break even point is 5/.004 = $1250

With Paypal Pro and Authorize.net (assuming a $30 monthly fee), your break even point is 30/.004 = $7500

Once again, your exact savings depends on your ability to negotiate rates down but Stripe is almost always cheaper if you process below $5/month and remains a good solution up to $10K/month.

Summing It All Up

When it comes to getting the best rate for credit card processing, it depends on your sales volume and your ability to negotiate. But whatever you do, don’t sit there idly and pay a higher rate out of laziness.

Get on the phone and demand a lower rate! After all, you can’t save money unless you ask.

In general, Stripe is the best credit card processor for new online stores because it’s 100% free with zero monthly fees.

But after a certain threshold, both Paypal Advanced, Paypal Pro and Authorize.net become much more economical solutions.

If you are doing high volumes of sales (>$50K), going with Authorize.net will almost always be your cheapest solution. But anything under that volume depends on your ability to find a good deal.

Good luck!

Ready To Get Serious About Starting An Online Business?

If you are really considering starting your own online business, then you have to check out my free mini course on How To Create A Niche Online Store In 5 Easy Steps.

In this 6 day mini course, I reveal the steps that my wife and I took to earn 100 thousand dollars in the span of just a year. Best of all, it's free and you'll receive weekly ecommerce tips and strategies!

Related Posts In Payment Processing

- Paypal Alternatives For Ecommerce Store Owners

- The Cheapest Credit Card Processing Option For Small Business – Stripe Vs Paypal Vs Authorize.Net

- How To Sell On eBay Without Paypal Using Managed Payments

- Stripe vs PayPal – The Best Payment Processor For Your Business

- PayPal One Touch – How This One Feature Increased Mobile Conversion Rates By 31%

Steve Chou is a highly recognized influencer in the ecommerce space and has taught thousands of students how to effectively sell physical products online over at ProfitableOnlineStore.com.

His blog, MyWifeQuitHerJob.com, has been featured in Forbes, Inc, The New York Times, Entrepreneur and MSNBC.

He's also a contributing author for BigCommerce, Klaviyo, ManyChat, Printful, Privy, CXL, Ecommerce Fuel, GlockApps, Privy, Social Media Examiner, Web Designer Depot, Sumo and other leading business publications.

In addition, he runs a popular ecommerce podcast, My Wife Quit Her Job, which is a top 25 marketing show on all of Apple Podcasts.

To stay up to date with all of the latest ecommerce trends, Steve runs a 7 figure ecommerce store, BumblebeeLinens.com, with his wife and puts on an annual ecommerce conference called The Sellers Summit.

Steve carries both a bachelors and a masters degree in electrical engineering from Stanford University. Despite majoring in electrical engineering, he spent a good portion of his graduate education studying entrepreneurship and the mechanics of running small businesses.

For everyone who is reading this comment, please read this carefully.

If you decide to go with MerchantPlus over Paypal make sure you ask them to set you up on Interchange Pricing vs Tiered Pricing (They are only quoting tiered pricing on their site and only showing ONE rate).

After doing a lot of research on the industry, and speaking with someone who has over 12 years experience in the business, this is how most credit card processors take advantage of you without you even knowing it.

Most of the time the rates they quote you up front (When on tiered pricing) are for a swiped pin debit transaction …and then when you get your statement you come to find out that you are being charged a higher rate than you were quoted because the majority of the credit card transactions that you process fall in your mid and non-qualified rate that they don’t mention to you when signing the contract.

Here is the bigger joke…

Depending on what processor you go with…they determine what credit cards you take fall into what rate…They can do this because there are over 300 types of credit cards and because most entrepreneurs are not savvy enough to really know what they are buying when it comes to credit card processing, it allows the processing companies to take advantage of you right under your nose.

The fairest pricing model is Interchange Plus…It is the fairest because you pay only the interchange rate on the card you are taking. (This part of the fee gets paid by you to the issuing bank who gave the customer the card). After paying the interchange rate, you also pay a basis point fee on top of the interchange fee that is determined on your average yearly processing volume.

There are other fees associated with this pricing as well such as transaction fee, batch fee, dues and assessments etc… but these fees also come with tiered pricing as well.

I hope this helped you out and will save you a lot of hassle and headache when setting up your merchant account.

If you have any further questions please don’t hesitate to contact me.

Hey Scott,

I’m not sure what you are referring to exactly, but I’ve used Merchant Plus and the rate is as advertised. Note however that this rate only applies to Visa/MC. Accepting American Express is a completely different story. If there were any anomalies with the rate, especially if it changed from credit card to credit card, we definitely would have noticed.

Hi Steve –

That is good to know.

The reason why I thought it was different (As I described above) is because on their pricing page it says Simplified 3-Tier Rate Plan with a quoted rate.

When I saw that, I immediately assumed that the rate quoted on the page was the rate you typically pay for qualified transactions…Where the mid-qualified and non-qualified rates are not shown (normally this is done on purpose, because they vary from processor to processor).

Normally most advertised rates are not what you will really be charged for the majority of your transactions.

I was looking at a merchant statement from my friend the other day…and even though they got a 2%ish rate on qualified transactions, they were paying a whopping 4.4% on non-qualified transactions (Because most of the transactions fell into this bucket they were really being taken).

When you have 3 tiered pricing, once a credit card is swiped it falls into one of the three rates. Qualified / Mid-Qualified / Non-Qualified.

Even though Visa Card #1 may fall into the qualified bucket, Visa Card #2 may fall into the Mid-Qualified bucket. It all depends on the card type, and the details associated with the card.

For example…

Say today I pay for products in your online store with a Visa card that gives me free airline miles, and then tomorrow I pay for some more stuff with a Visa card that is just issued with my bank that doesn’t give me any perks for using it.

The “bucket” the first credit card would fall into, would be different than the second credit card would fall into … even though they are both Visa. More than likely the first card would fall either into the mid or non qualified bucket, where the first one would fall into the qualified bucket and obviously be charged a different rate

Does that make sense?

Normally when looking at your merchant statement, most companies make it so confusing for entrepreneurs to distinguish what they are really being paid, and more times than not when you calculate the true effective rate they are paying…it is far higher than they should be paying.

Regardless, I’m going to contact them to get further clarification. Thanks for the heads up.

So I wrote a follow up article that covers all of the nuances of merchant account fees. Check it out below.

https://mywifequitherjob.com/hidden-costs-of-accepting-credit-cards-online/

COMMENT EDIT:

I just re-read my last comment in the thread, and there is a mistake I want to clarify.

In this paragraph there is an error…

The “bucket” the first credit card would fall into, would be different than the second credit card would fall into … even though they are both Visa. More than likely the first card would fall either into the mid or non qualified bucket, where the first one would fall into the qualified bucket and obviously be charged a different rate

The edit is marked in CAPS…

The “bucket” the first credit card would fall into, would be different than the second credit card would fall into … even though they are both Visa. More than likely the first card would fall either into the mid or non qualified bucket, where the SECOND CARD would fall into the qualified bucket and obviously be charged a different rate.

Sorry for the possible confusion.

I agreed with what Scott described. If you take a very close look at your monthly statement, each transaction is being charged with different rates if you were in a multi-tiered rate structure. I found out a long time ago that most of my transactions were being charged more than 4% which is higher than the non-qualified rate of 3.7%. By the way, I’m not using Merchant Plus, so my experience does not apply to them. I’m using a different merchant but wondering if there are any better ones out there that would not throw in some hidden charges to us sellers?

Thanks for the article and Scott’s comment.

Sounds like an excellent option from Paypal – thanks for the thoughtful advice.

Such an important piece of information you provided my friend. I don’t have a store yet but I use 2checkout for accepting paypal and other CC’s for my web design clients.

I am on my way to offer a couple of digital goods on my website and I am using a simple paypal plugin for the payment method.

We are interested in switching, but I’ll wait for the clarification.

Thanks, Steve

Thanks Scott and Steve. I’ll be signing up for a merchant account and payment gateway within the next week, and already planned to go with an Authorize.net reseller. Steve, if you can work out a better qualified rate I’ll gladly sign up under you. The monthly fee and transaction fee are otherwise competitive.

Hey Brian,

I’m negotiating right now to get 50 basis points knocked off the rate. I’ll let you know

Ok. Its done. Everyone who signs up with coupon code: MYWIFEQUIT gets 20% off the monthly fees in addition to 50 basis points off the mid qualified and non qualified rate. All previous signups will be converted to this new rate as well. In addition, if your sales volume is large enough, then you are also eligible for interchange plus as well.

Hi,

Since there’re no dates mentioned anywhere, I’m not sure when was article written, but I’d love to know how to be PCI compliant if you say its really not that complicated or expensive.

So basically, I’m looking for a merchant account + gateway API that I’ll use with app to charge customers. Ideally I’d like to store cards, but I’m fine with storing card data with the provider.

Thanks so much Steve and Scott. This discussion has proven very helpful, as I am now able to know enough to negotiate with merchant account providers. And they do just quote the lowest rate, and you have to push them to give you the whole story. It’s kind of scary; had I not read this, I would have been totally taken advantage of (and possibly I still am, but less so :).

We haven’t used it yet but Stripe seems to be a pretty good option for accepting online transactions with a flat fee and no PCI compliance issues. Implementation seems fairly easy for a competent developer. We are planning on using it for some of our subscription billings and possibly more down the line.

As part of another business I am in, I do use a standard merchant account, and the transaction fees are all over the place. I long ago gave up trying to shop that around as everyone gets you either coming or going!

Thank you for this synopsis but… why is there no date? How can I tell if I am looking at information that is likely to be accurate, or 5 years out of date?

Without a date on this article, it is unfortunately fairly useless…

I get a lot of traffic to this post, so I always keep it up to date. Is there any specific question you have?

So which site is giving the discount with your coupon code? And will that discount come out better for a low volume sales site than PayPal? Thanks for taking the time to sort all this out.

using prestashop with stripe.com with a ssl certificates make you PCI compliant

https://support.stripe.com/questions/do-i-need-to-be-pci-compliant-what-do-i-have-to-do

thanks to God that things is more easy finally

Yep, Stripe definitely works and is easy but it will end up being more expensive than PayPal in the long run.

why!? both have the same fees 2.9% + $0.30, and paypal we need to pay the 30$ of monthly fee to be able to integrate it with our site (there is the new product called PayPal Payments Advanced with only 5$ per month but I couldn’t find any decent cart that support it yet,there is only magento witch is a heaven to use and need a VPS at less,prestashop opencart virtuemart woocomerce doesn’t support it yet)

so the prices I think are like this now

stripe: 0/month 2.9% + $0.30 per transaction

paypal: 30/month 2.9% + $0.30 per transaction

paypal will be good only if our sales volume is

$3,001+ to $10,000 2.5% + $0.30*

$10,001 to $100,000 2.2% + $0.30*

and there is hidden things in paypal (international fees is not 2.9% + $0.30 )

1/ “International Sales: 1.0% Applies to payments from another country. cross-border fee and/or 2.5% currency conversion fee”

look at this huge per cents https://www.paypal.com/us/cgi-bin/marketingweb?cmd=_display-xborder-fees-outside&countries=

2/American Express© card usage fees: 3.5% per transaction

while stripe doesn’t charge anything for this,i copy past what stripe says in there site

“No setup fees, no monthly fees, no minimum charges, no fees for validations or failed transactions, no fees for different card types (e.g. American Express, corporate cards, rewards cards), no fees for international cards, no card storage fees.

here is a beautiful comparison between both for long term

http://ecommerce.shopify.com/c/payments-shipping-fulfilment/t/comparison-of-shopify-payments-with-stripe-vs-paypal-pro-148923

I think right now there is only one way to have benefit with paypal: first using magento because of compatibility, then sell to USA customers only, then make more than 3000$/month in sales, if we have this three points then yes “strip will end up being more expensive than PayPal in the long run. ”

please correct me if I m wrong, this is my first research in this things I hope not to make some stupid noob errors for my first US client

thanks for you answer

I believe you just answered your own question. If you only ever plan on making under $3000 a month then it doesn’t matter:) Once you get more volume, it pays to get a merchant account with interchange rates.

Your statements about PP Advanced are not accurate either. All of the major carts support PP Advanced with an addon.

thank you Steve

I didn’t know that PP advanced exist in paid add-ons because I was searching only free lol, thanks again 🙂

please can I integrate merchantplus with prestashop (using the authorize.net plugin that comes with prestashop) as you did with opencart here https://www.youtube.com/watch?v=aeE89wn8sgA , because merchantplus chat didn’t gave me any clear answer neither prestashop.

I don’t want to use opencart because the owner (Daniel Kerr) is very bad person with very bad attitudes and the most dangerous is that the owner (Daniel) do not care of our security, look this bad history and how he treat and insult developers wanting to help him (read Daniel comments here)

http://blog.visionsource.org/2010/01/28/opencart-csrf-vulnerability/

http://www.techchattr.com/never-use-opencart

opencart is one person developer now because the owner doesn’t accept developer help or advices…

if the merchantplus integration is impossible do you know any other merchant account like merchantplus because I cant find any better merchant that can bet this 0.3% + $0.25 (30 $/month)

Daniel deals with a lot of riff raff on a day to day basis. While he did not react that well in the comments of that post, the author of that article was totally off base citing completely inaccurate claims for the most part which clearly pissed him off. I would not take that as a representation of his character.

The other article on security is from 2010. OpenCart has been one of the more secure carts out there. It is also coded in a very simple easy to understand manner which makes it easy to edit. Outside of one vulnerability that I can remember from version 1.4x, it’s been awesome.

Thanks for this clarification, I couldn’t decide by myself but just follow because they seemed to know what they are talking about, but now it s more clear for me (because it doesn’t make sense to have this bad reputation and vulnerabilities and still being the third or second used shopping cart in the world without any type of advertising,or maybe the first in the world if we exclude the huge Magento advertising budget).

the good in opencart is that it comes with a lot of free payments methods and OP addons prices are very low compared with prestashop or magento.

thanks Steve for your answers and time

have a nice day and life 🙂

Skrill is a strong merchant account too

better than stripe and paypal

https://www.skrill.com/en-us/business/merchant-fees/

no monthly fee and 2.90% + $0.29

up to $ 3,000 2.90% $0.29

$ 3,000.01 – $ 10,000 2.40% $0.29

$ 10,000.01 – $ 100,000 2.00% $0.29

more than $ 100,000 1.70% $0.29

free plugin for prestashop

paid plugin for opencart

Hello,

I have been trying to get some info on Paypal Advanced and am coming up with zero…

I sent PayPal an email regarding Paypal Advanced and am awaiting their response…

I can only find PayPal Payments Standard and PayPal Payments Pro.

Hi

Wow I didn’t realize how difficult this was about accepting payment on an online store. My first question would be, what does your shopping cart have to do with accepting payment? I’m having Site builders build my website for me and I have no idea about the shopping cart. Also I have read all your info and I’m still confused on what to get to accept payments on my store. Since this is my first bulk order and brand new I’m not sure what I need to do to accept form of payment. Can you kinda help me with this. I’m not sure either how much sales I will have since this is my first bulk order. Although my product is the only Patent out their of its kind and I have been wearing them for a year with an overwhelming reaction, I’m hoping for at least more than $3,000.00 per month.

Thanks

Casey