Whether you sell physical or digital products online, at some point you’ll experience a credit card chargeback no matter how good your customer service is or how great your products are.

Now before I begin, I want to explain the definition of a credit card chargeback. As you know, whenever you buy anything with a credit card, the credit card company protects you from any sort of fraud that a merchant might commit.

This includes incorrect amounts charged to your card, failure to deliver the goods as promised or shipping faulty or damaged products. When any of these things happen, you can call your credit card company and they will issue you a refund if certain conditions are met.

This protection is one of the primary reasons why I always use my credit card to make any large purchase.

However as with everything in life, credit card chargebacks can be abused by your customer at your expense whenever you sell something online.

First off,I want to say that our online wedding linens store has only experienced 3 or 4 chargebacks in the last 9 years of business and we have won them all.

However for my online course, I’ve probably gotten closer to 7 or 8 in the last 5 years and my track record for winning hasn’t been nearly as good.

Recently however, I won my last 2 digital course chargebacks which is the main reason why I’m writing this post today. In the past, winning a digital download related chargeback was nearly impossible. But today, there are many ways to fight your case.

The key point is that no matter what you sell, whether it be digital or physical, there are many things that you can do to prevent chargebacks.

Reasons For A Customer Filing A Credit Card Chargeback

Some chargeback claims are legit but there will always be customers who abuse the system. The amount of sleazy customers that you have really depends on your clientele and what you sell.

My buddy who sells electronics has had many more problems than I’ve had because there are many more ways to complain about non functional electronic merchandise.

That is why I always stress that it’s important to sell something that isn’t fragile or easily damaged during shipment.

Most chargebacks usually involve one of the following situations.

- A customer claims you never delivered the product. Incidentally, this is the easiest one to dispute.

- A customer claims you shipped them something broken

- A customer claims that they never ordered the product

- A customer claims that they issued a return but you never refunded their money.

Get My Free Mini Course On How To Start A Successful Ecommerce Store

If you are interested in starting an ecommerce business, I put together a comprehensive package of resources that will help you launch your own online store from complete scratch. Be sure to grab it before you leave!

Fighting Chargebacks For Physical Products

On the surface, you would think that fighting a physical product chargeback would be easy and straightforward. You simply send the credit card company proof of delivery and voila! You win right?

Not quite…

Just because you have proof of delivery does not mean you will win. In fact, if the customer is deliberately trying to defraud your company, you must take active measures to not lose money.

Here are a bunch of things you can do to prevent chargebacks.

- To prevent undelivered product claims, the solution is simple. Use a delivery service that offers delivery confirmation. FedEx and UPS offer it for free and USPS offers a notification service at a minimal cost. This is required!! Don’t go cheap and not pay for it because you will definitely be asked for this information.

- If the order is greater than $250, always pay for signature confirmation. Having a signature on the package will help fight claims where the customer claims the order was never received even though it’s marked as delivered.

- To prevent broken merchandise claims during shipping, always purchase shipping insurance if your items are fragile. If the goods arrive at their destination with visible damage to the packaging, have the customer refuse shipment or have the carrier return to sender so you can file a claim.

Make sure you clearly document the timeframe with which to handle these claims and make sure that the customer doesn’t throw away the packaging. Usually, the insurance process takes a long time so you need to file a claim asap.

- To handle claims of broken merchandise not caused by shipping, you can do one of two things. You can have the customer contact the manufacturer directly if the item is under warranty or you can have them ship the item back to you. Once again, make sure your return policy is very clear about the timeframe and the RMA process.

- If the customer claims that they never ordered the product, make sure you have clear documentation of their order. Never ship any merchandise to an address other than the billing address for the credit card.

- Finally if a customer claims to have made a return, ask for a confirmation number. If they can’t produce one, then the credit card company will likely not issue a chargeback.

When You Can’t Obey All The Rules

While most of the items above are common sense, there are times when you can’t obey all of these rules without potentially pissing a customer off.

For example if you refuse to ship to a different address other than the billing address over the holidays, you’re going to lose a lot of business.

This is when you have to do some due diligence for yourself and make a judgement call.

First off, any customer who makes a large order and pays for rush delivery to an address other than the billing address REQUIRES scrutiny.

Here’s what I do for all suspicious orders.

- I check the IP address of the customer. If the delivery address is in the United States and the IP is somewhere outside of the country, it’s a huge red flag! I almost never ship the order. We do this check manually for certain orders but you can use a service like MaxMind to do this check automatically with your shopping cart. If you sell high ticket items like electronics, then it’s probably worth the money

- I call the customer. Especially if the order needs to be rushed, I’ll call the customer and ask exactly what their deadline is and why they need their items so quickly. From there, it’s a judgement call based on your conversation. If the person seems legit, then go ahead and ship the order.

- I stalk the customer. You’d be surprised how much information you can find about an individual just by doing a few searches online. Sometimes an innocent Google search may turn up a scam. In any case, I do the “customer stalk” as a last resort if I’m still not sure about the validity of a purchase after doing the first 2 items above

Fighting Chargebacks For Digital Products

Winning a chargeback for a digital product is much much harder than winning a chargeback for a physical product. With a physical product, you have proof of delivery but with digital, you basically have nothing but a receipt.

That is why you have to go out of your way to track people who buy your digital goods if you want to have any hope of winning a chargeback.

Here’s what I do.

For context, I run a membership site called Create A Profitable Online Store. And when anyone accesses my info product, they have to login.

Whenever someone logs in, I track their IP address and every single page that they’ve accessed on my site and for how long. If you ever get a chargeback, you may need to show all of this activity to the credit card company.

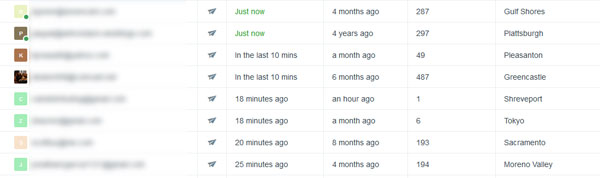

One of the ways I track digital customers is by using a service called Intercom.io. Now this service was intended to be used as an email marketing tool that triggers based on user activity. However, it works really well as a customer tracking tool and it’s 100% free!

Here’s an example of what Intercom.io can tell you

I also track customer behavior in Google Analytics by using custom variables that allow me to know who is doing what.

Finally, I also keep track of all email correspondence and forum usage on my site.

The last 2 chargebacks I received were from people who claimed that “they never signed up for the class”. So when I got the chargeback, I pulled server logs of every one of their sessions, their IP address and a copy of all email correspondence.

The IP address they used to make the purchase matched their location and all of the logins occurred from the same IP address. When I presented the evidence to the credit card company, they denied the charge back.

The Key To Winning Chargebacks

In general, your chances of winning a credit card dispute are greatly improved if you maintain good documentation. Always handle all correspondence via email if possible so you have a precise record of all conversations.

One other thing that I suggest is to make sure that your store name is what appears on a customer’s credit card monthly statement. When I first set up our credit card merchant account, I set it to a shorthand version of our store name.

This caused some confusion for certain customers because they didn’t recognize our store name in their monthly statement.

I would also go as far as to document the shipping and returns policy on every single document that a customer sees. This includes the invoice and at least a mention during the checkout process.

Overall, I don’t worry too much about chargebacks. There are checks and balances on both ends to prevent fraud.

Ready To Get Serious About Starting An Online Business?

If you are really considering starting your own online business, then you have to check out my free mini course on How To Create A Niche Online Store In 5 Easy Steps.

In this 6 day mini course, I reveal the steps that my wife and I took to earn 100 thousand dollars in the span of just a year. Best of all, it's free and you'll receive weekly ecommerce tips and strategies!

Related Posts In Payment Processing

- Stripe vs PayPal – The Best Payment Processor For Your Business

- How To Sell On eBay Without Paypal Using Managed Payments

- The Cheapest Credit Card Processing Option For Small Business – Stripe Vs Paypal Vs Authorize.Net

- How To Fight, Win And Prevent A Credit Card Chargeback

- PayPal One Touch – How This One Feature Increased Mobile Conversion Rates By 31%

Steve Chou is a highly recognized influencer in the ecommerce space and has taught thousands of students how to effectively sell physical products online over at ProfitableOnlineStore.com.

His blog, MyWifeQuitHerJob.com, has been featured in Forbes, Inc, The New York Times, Entrepreneur and MSNBC.

He's also a contributing author for BigCommerce, Klaviyo, ManyChat, Printful, Privy, CXL, Ecommerce Fuel, GlockApps, Privy, Social Media Examiner, Web Designer Depot, Sumo and other leading business publications.

In addition, he runs a popular ecommerce podcast, My Wife Quit Her Job, which is a top 25 marketing show on all of Apple Podcasts.

To stay up to date with all of the latest ecommerce trends, Steve runs a 7 figure ecommerce store, BumblebeeLinens.com, with his wife and puts on an annual ecommerce conference called The Sellers Summit.

Steve carries both a bachelors and a masters degree in electrical engineering from Stanford University. Despite majoring in electrical engineering, he spent a good portion of his graduate education studying entrepreneurship and the mechanics of running small businesses.

Thanks for this. I always struggled in this area when I worked with Clickbank not so long ago. Will bookmark for the future.

I have created an Html module that allows customers to literally sign your check out lane. The signatures are stored on a secured server and can be accessed at any time to prevent fraud and fight credit card charge backs. It works with both php and .net and it is as simple to install as a simple image. Check it out at http://secured mark.com

Thank for sharing! great idea.

A tracking number isn’t enough proof of delivery. Just lost $2400 from a Katherine Quillen because she claims her items were never delivered. but yet the tracking info shows it was delivered and UPS even confirmed with her that it was delivered. the CC company said i have to have a valid signature to prove that it was delivered. So basically if you ship anything you can be screwed by these crooks. Cash is apparently the only way to go.

For shipments over 250 dollars, you should always select signature confirmation

I am facing a situation that I cannot find any information about. My customer ordered custom handmade goods and received her goods but they were damaged during shipping. She contacted me immediately about some of the items being damaged, I offered to refund right away but she insisted that I remake the items as she really wanted them. I asked her to send me a list of the undamaged items so I could concentrate on remaking only the damage items and she said she would supply that list immediately. And then I didn’t hear from her for 44 days. She said she didn’t realize I was waiting on something from her and that she changed her mind, that she wanted a refund. My store policy indicates refunds are issued up to 7 days after receipt and returns and exchanges are made only up to 30 days after receipt of the goods. I told her I was unable to refund her order because it had been 45 days from receipt of her order but did offer her a partial store credit. so now she is supposedly pursuing a chargeback. I would like to find information about a situation where declared store policies are expired. Any ideas?

Hi Gwen,

Personally, I would simply issue the refund. The amount of headaches and potential feedback backlash is not worth your time or mental anguish.

Not sure when this was posted…

I am about to enter the e commerce market and I haven’t signed yet the terms of the payment gateway. I noticed in the contract that the merchant would be completely liable for chargebacks. Apparently some smaller eshops had to close their businesses because of credit card chargebacks. The item was out on delivery when the chargeback happened which complicated the whole story of course. How can I as a merchant secure myself better? The only thing that comes to my mind is to disclose a clause in the cancellation terms, saying that cancellation after sending out the parcel is not possible. Do you have any suggestions to that? There must be a way to secure oneself no?

Unfortunately, you can’t prevent chargebacks. But if you provide all of the delivery documentation for the goods, then you can fight it. In your case, the CC company would probably force the customer to ship back the goods.

I sell information that is downloaded after payment, hence no hysical tracking of delivery of goods. I was recently had 12 chargebacks from 1 customer who claimed his card was used fraudulantly. I lost the case because there was no physical proof and that my payment processor didn’t have 3D security (they ask for the usual card number, name and security code) but not by entering a code sent by SMS. I chose not to go down this path as this create another barrier to purchasing. Not only did I lose the sales but the bank charged me $30 for each chargeback! ($360)

Seems to me that the merchant is the one who loses out each time.

That’s one of the downsides of selling digital goods online. You will rarely be able to win a chargeback case.

It’s not reasonable for us to “not ship any item unless it’s to the billing address” because 25-50% (depending on the season) of our orders are gifts. If anything seems suspicious (we have a few checks), we will call to verify the order first. I have only lost a chargeback once, it’s a cost of doing business.

Pretty! This was a really wonderful article. Thanks for supplying this information. 🙂

Customers who know the system can easily abuse it and they are definitely abusing it.

Credit Card companies need a signed signature in order for you to win the case.

Sometimes even when you have a signed signature, if it is not the customers’s you can still loose the case.

I have been in situations where I initially won based on just delivery confirmation and then the customer disputed for the second time again. And now the customer disputed it again . The credit card asked again for a signed signature which I did not have because it was a $49 order.

Also, when it comes to paypal, in order for you to be covered by seller protection you have to ship to the address that is on the paypal account.

Ways to protect yourself

1. Get Insurance for your company there are companies that will deal with the carriers for you and meanwhile refund you your money. Believe me you do not want to do the back and forth with USPS.

2. Require signatures over a certain amount, mine is $70

3. Always follow up with email for customers asking to ship to a different shipping address different from the billing. ( this happens)

4. Something else am thinking of putting in place having customer check a box during checkout if they want to sign for the package or not ( not sure how this will work)

Something else I forgot to add to my previous post.

Budget Chargebacks to your expenses. Have $1,000, $2,000 every month as an expense for chargebacks depending on your niche.

Awesome post and great advice!

I’ve never heard of Intercom.io but I’m definitely going to check it out and see if it’ll work for me.

Hey Steve,

I recently had a friend who ran into a chargeback issue. A kid ordered $900 worth of merchandise on his mother’s credit card in multiple orders. The kid’s tumblr shows pictures of him enjoying the merch, so he clearly got it in good condition. But the mother reported them as fraudulent charges. He contested it, however, credit card company is still ruling it as fraud because the kid ordered it, not the mother. Is there anything he can do in this situation?

Best,

Rachel

Chargeback is no fun. I automate the IP address screening and review using 3rd party fraud prevention tool in Shopify. It works like a charm and it is free if you have less than 500 orders per month.

Merchants can actually shift the liability from them back to the customer when utilizing charge back mitigation tools integrated into your payment gateway. Check out PayCertify, they offer 4 different tools that can all be integrated directly to their online portal.