Twice a year, I publish an income report to track the progress of my various online businesses.

And in case you are new here, my primary sources of income are my online store at BumblebeeLinens.com and my blog at MyWifeQuitHerJob.com.

In addition, I run a small business podcast and an ecommerce conference called the Sellers Summit. Feel free to check them out!

On this page, I post the most up to date income reports for my businesses which usually come out in January and July of every year.

Note: As of 2019, I have stopped publishing income reports with full revenue numbers. Not only was it making my wife uncomfortable but it got to the point where they sounded presumptuous and no longer added value to the blog.

Instead, I now publish year end reviews for both of my 7 figure businesses which outline the changes and updated strategies for the year.

As of right now, the latest year end report for my online store(Bumblebee Linens) can be found here.

And a link to the latest year end report for my blog can be found here.

If you want to learn how to start your own profitable online store, click here to sign up for my free 6 day mini course.

Get My Free Mini Course On How To Start A Successful Ecommerce Store

If you are interested in starting an ecommerce business, I put together a comprehensive package of resources that will help you launch your own online store from complete scratch. Be sure to grab it before you leave!

Which Business Model Is Better? Blogging Or Ecommerce?

Because I’ve had a good amount of success with selling physical products online and blogging, I often get asked which business model is the best one to pursue. In fact, here’s an email I received the other day from a reader of the blog.

Hey Steve, I’m thinking about starting an online store or a blog very soon and I’m thrilled I found you. I know that you’ve done both so I wanted to know which business model you recommend for someone just starting out.

Thank you for sharing your wealth of knowledge! -Kay

First off, the answer to this question is fairly complicated and largely depends on your personality and your long term goals.

But by reading about my experiences with both business models below, you should be able to decide for yourself.

Let’s start with blogging first.

How Much Do I Make Blogging?

Before I delve into the numbers, I just want to say that I’ve always been a little embarrassed by how long it took me to make meaningful money with MyWifeQuitHerJob.com.

In fact, a bunch of my other blogging buddies started around the same time as I did and many of them are either making more money than I am or have a larger reader base than I do.

As of today, I’ve been blogging for almost 7 10 years. And to tell you the truth, I’ve probably put more hours into writing articles for MyWifeQuitHerJob.com than I have spent working on my online store.

Writing also doesn’t come that quickly or that easily for me. And to make things worse, no one was reading my blog during the first 2 years.

Even my Mom used to tell me…

Why would people possibly want to read your posts and pay you money?

The Tipping Point

But after about 2 years of blogging to a really small audience, something magical happened during year 3.

My blog started to generate some serious traction. And low and behold, I started gaining traffic and regular readers on an exponential growth scale.

In 2012, I broke 6 figures for the first time.

In 2013, I made $171,000.

In 2014, I broke $350,000.

And in 2015, I hit $712,000.

And in 2016, I hit $1,000,000.

And in 2017, I hit $1,400,000.

As mentioned earlier, 2017 was the last income report that I published and I probably won’t put out anymore until I hit another major milestone.

Click here to read the last income report I wrote up for MyWifeQuitHerJob.com.

After years and years of slogging away at the keyboard for no money, I’m ecstatic to finally enjoy the fruits of my labor.

But folks, if you are trying to make money fast, then blogging is not the answer.

You can easily make much more money with an online store in a much shorter period of time than you can with blogging.

For example, my wife and I made over $100,000 in profit in our first year of business with our online store.

But with my blog in the first year, I maybe made $100 but that’s probably pushing it.

Editor’s Note: If I started my blog all over again from the beginning knowing what I know now, I could probably start making 4 figures/month within a year

The Intangible Benefits Of Blogging

But money aside, blogging is an incredible way to express yourself and to build an audience.

First and foremost, a blog allows you to create a loyal following. Simply knowing that someone is out there reading my stuff is quite satisfying and makes me happy every time I hit the publish button. (Take that Mom!)

I’ve also met a ton of new people through blogging that I would not have met otherwise. And many of these people I now proudly call my friends.

By writing and podcasting about ecommerce, I’ve also inadvertently positioned myself as an authority in the ecommerce space. As a result, I’ve been offered a few book deals (including an offer from Wiley Publishing).

I’m also constantly bombarded with free products and free software to review. And I even launched a successful ecommerce course that now has ~3000 students!

There’s no way that would have happened without my blog.

Most importantly, I feel like I’m making a difference in this world by teaching others how to start their own businesses. This last point is crucial.

It’s hard to describe the feeling but helping others take charge of their lives is probably the most satisfying part of blogging.

Blogging Vs Ecommerce

If you’re like my Mom, you’re probably wondering how a blog can possibly make money.

With MyWifeQuitHerJob.com, I generate income primarily through advertising, affiliate marketing, podcast sponsorships and online course sales. And the best part is that these income sources are passive in nature.

But as I mentioned earlier, it takes a tremendous amount of time and effort before you can make even a single penny.

If you decide to start a blog for the sole purpose of making money, don’t expect to make any meaningful revenue for at least a few years because you need to build an audience first.

If your goal is to make money immediately, then go into ecommerce and start selling something online.

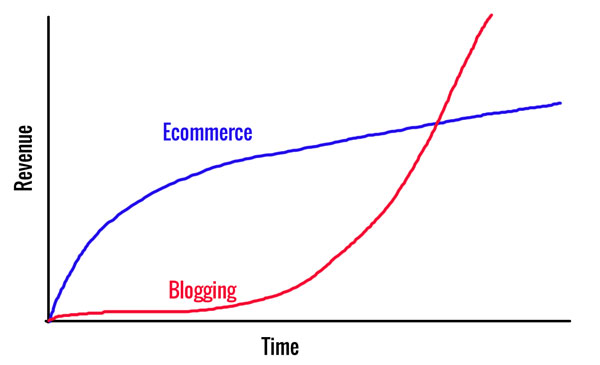

Starting an ecommerce store will almost always make money faster than a blog because you don’t need that much traffic to sell your own goods and the payout per sale is often much higher.

But the beauty of blogging is that once you start getting some momentum, your growth potential is limitless and the margins are incredible!

Last year, my ecommerce store generated more revenue than my blog, but my blog was more profitable.

Why? It’s because the money I made from blogging was more or less pure profit.

Unlike running an ecommerce store, I don’t have additional overhead in the form of inventory and office space. And even though my ecommerce store made a lot more money during its first 5 years of existence, my blog is growing much faster today.

To put things in perspective, here’s a graph I threw together that demonstrates the growth curves of both business models.

So What’s The Verdict? Should I Start A Blog Or An Online Store?

If you have less than $500 to start a business or if you don’t know what business you want to start, I would advise that you start a blog and put yourself out there.

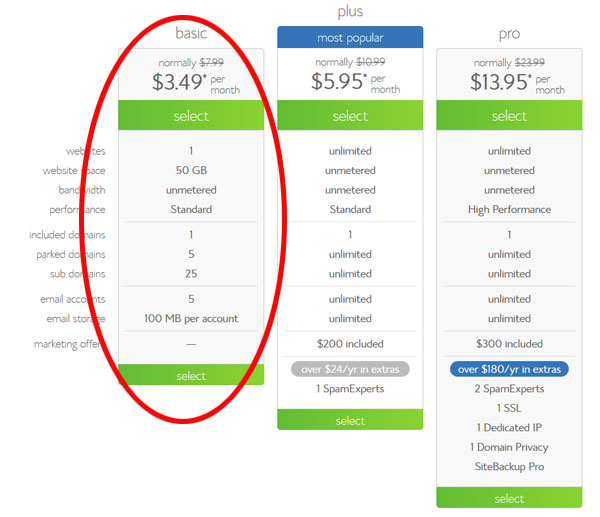

The starting costs are super low ($3.95/month) and by building an audience now, you will have a place to market your products to when you are ready to start selling.

Remember, blogging is an excellent way to get your ideas out to the masses, to establish yourself as an authority and to reach out to other experts around you.

What’s really nice about MyWifeQuitHerJob.com is that the majority of the money I earn is passive income.

Unlike my ecommerce store, I don’t have to worry about carrying inventory, customer support, customer acquisition, importing goods from overseas etc..

The real question that you have to ask yourself is whether you have the patience to get through the initial slow period of blogging or whether you want to start making money right away.

If you want to make money faster, then sign up for my FREE 6 day mini course on how to start your own profitable online store.

If you prefer generating more passive income, continue reading and I’ll show you how to get started blogging right now in under 5 minutes for less than $4/month.

How To Start A Blog

First off, if you are interested in ever making money off your blog or turning it into a business, then you must host it yourself and own your domain and website.

This is absolutely required.

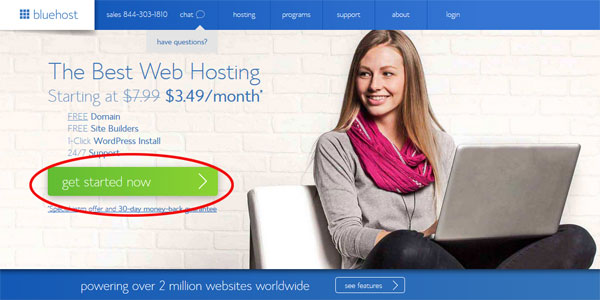

Right now the best blogging platform available is WordPress. And an economical way of getting started is by hosting your WordPress blog on Bluehost.

Not only does Bluehost only cost $3.49/month, but I actually ran my ecommerce store on Bluehost for 2 years before I transitioned to dedicated hosting and I’ve had very positive experiences with them.

Blogging has been one of the best things ever to happen to me and has allowed me to quit my job. Today I work from home, travel whenever I want and attend all of my kids’ activities.

Below, I’ve written step by step instructions on how to start a WordPress blog in the easiest way possible and for the lowest possible cost using a reputable webhost.

Step 1: Sign Up For Webhosting

Instructions How To Sign Up

- Go To The Blue Host Website

- Click On The “Get Started Now” Button.

- Select A Plan

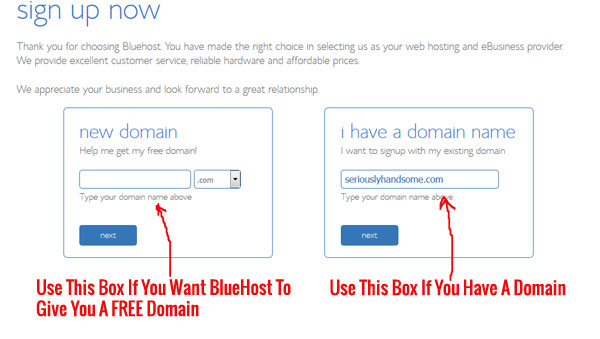

If you’re just starting out, just go with the cheapest plan which will be fine until you reach about 1000 visits per day. - Type In Your Domain.

Note: If you already own a domain, simply type it in.

- Enter Your Account And Billing Information.

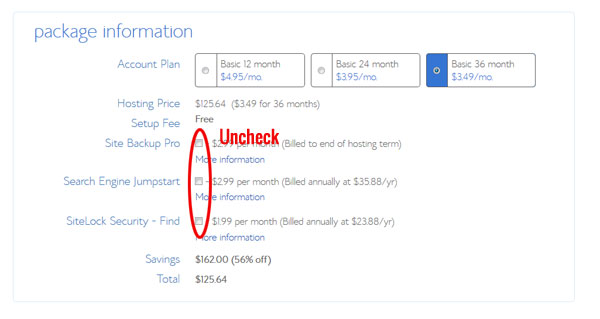

- Choose Your Hosting Package. You will be given a choice of 12 months, 24 months or 36 months. The longer the time frame, the cheaper it will be.

- Make sure you unclick all the stuff you don’t need. Trust me. You don’t need SiteLock Domain Security, Site Backup Pro or Search Engine Jumpstart

- Click Next. You will receive a confirmation in your email.

Step 2: Install WordPress

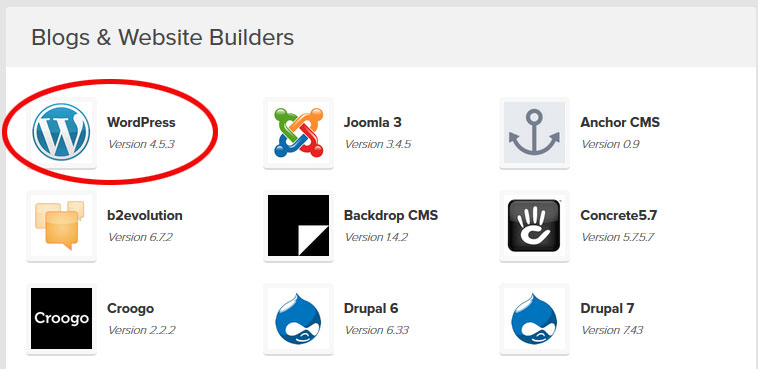

WordPress is by far the most popular blogging platform out there. And the best part is that you can install WordPress in a matter of just a few clicks on Blue Host

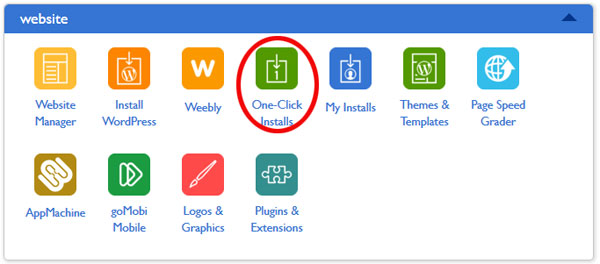

- Go Back To Your Bluehost Control Panel Front Page. If you forgot how to get to your control panel, Click Here

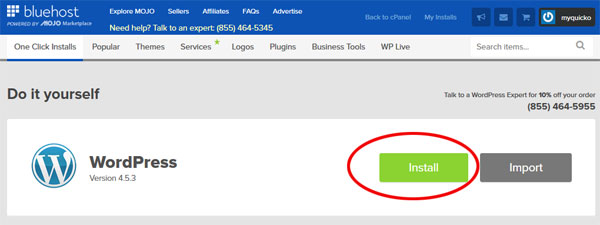

- Click the icon that reads “One Click Installs” under the “Website” section in your cPanel.

- Select WordPress To Be Installed

- Click on the “Install” button

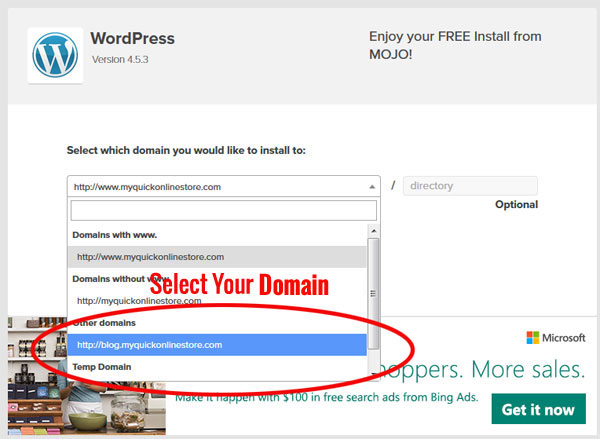

- Enter Your Domain

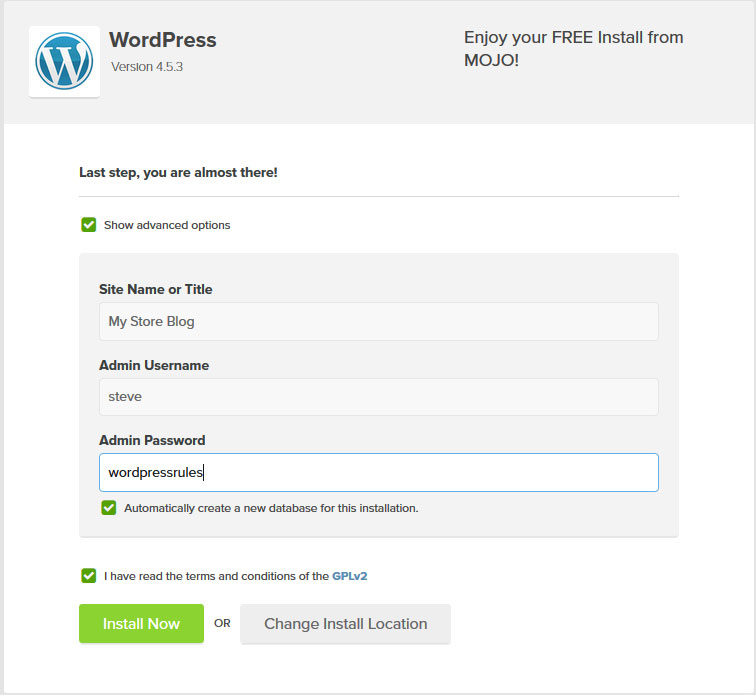

- Enter In Your Blog Username And Password

- Click “Install”. Now WordPress has been uploaded to your domain!

To sign into your WordPress account, all you have to do is type the following url into your browser

yourdomain.com/wp-admin

Login with the username and password you selected during installation. Click “Add New Post” and begin blogging!

There Are Many Different Ways To Make Money Online

Whether you decide to build an ecommerce store or start a blog, just keep in mind that there are many different ways to make money online.

Overall, your decision should be based on how much money you are willing to invest and your time frame to profitability.

If you are interested in starting an ecommerce store, I would recommend starting with at least $500. And once again, sign up for my free 6 day mini course if you want a good overview of the process.

If you are unsure about what business you want to start or if you don’t have the funds, then start blogging and building your audience now! By creating a loyal following, you are paving the way for your future. Good luck!

photo credit: Poetry in Motion

Ready To Get Serious About Starting An Online Business?

If you are really considering starting your own online business, then you have to check out my free mini course on How To Create A Niche Online Store In 5 Easy Steps.

In this 6 day mini course, I reveal the steps that my wife and I took to earn 100 thousand dollars in the span of just a year. Best of all, it's free and you'll receive weekly ecommerce tips and strategies!

Related Posts In Our Story

- My Thoughts On Making Money And Planting Money Seeds

- How To Be More Productive – 8 Simple Habits To Get More Done

- Every Tool And Plugin I Use To Run My 7 Figure Blog, Podcast And Online Course Membership Site

- The Secret To A Healthy Relationship With Money

- How To Prevent A Website Crash When You Make The NBC Today Show

Steve Chou is a highly recognized influencer in the ecommerce space and has taught thousands of students how to effectively sell physical products online over at ProfitableOnlineStore.com.

His blog, MyWifeQuitHerJob.com, has been featured in Forbes, Inc, The New York Times, Entrepreneur and MSNBC.

He's also a contributing author for BigCommerce, Klaviyo, ManyChat, Printful, Privy, CXL, Ecommerce Fuel, GlockApps, Privy, Social Media Examiner, Web Designer Depot, Sumo and other leading business publications.

In addition, he runs a popular ecommerce podcast, My Wife Quit Her Job, which is a top 25 marketing show on all of Apple Podcasts.

To stay up to date with all of the latest ecommerce trends, Steve runs a 7 figure ecommerce store, BumblebeeLinens.com, with his wife and puts on an annual ecommerce conference called The Sellers Summit.

Steve carries both a bachelors and a masters degree in electrical engineering from Stanford University. Despite majoring in electrical engineering, he spent a good portion of his graduate education studying entrepreneurship and the mechanics of running small businesses.

Steve I love your stuff and your blog and please keep this going!

Brian

Thanks Brian. I have no intention of shutting the blog so don’t worry.

Hi Steve,

First off, congratulations on your dedication and perseverance. And you are making a difference. Enjoy the rewards that have come from this effort…you have certainly earned them!

Mark

Thanks Mark!

Hey Steve,

You deserve every success in your blog. Through life coaching sessions and reading blogs such as yours, I have quit my very last corporate job. I am just starting to get my blog up and running. I would love to maybe take your course later this year. I am in the technology business too – software – however an online store has a lot of appeal for me.

Keep the inspiration coming, you are making a dent in this universe my friend!

Best,

Kay

Thanks Kay. I would love to hear your story about how you quit your corporate job. What is your blog URL?

Hi Steve,

I just found your site a few weeks ago. It’s really great; you actually offer concrete tips on how to make money online (unlike many other marketing blogs out there).

Do you think you can show us a snapshot of how your visitor traffic has grown over the years? Why do you think you started getting so much more traffic in year 3? Was it just because you started ranking higher, or did you help it along with social media, relationships, etc?

Thanks!

Hi Elaine,

It’s funny, I was just looking at my visitor traffic snapshot and it actually looks like a straight line. I think it’s a bit skewed since I used to invest heavily in Stumble Upon and other forms of social media for traffic that didn’t really stick. I think the main reasons it has shot up are because

1. I started an email list

2. I started offering a signup bonus (my mini course)

2. Certain articles started ranking in search

3. I found a good support group

Steve, you definitely have made a difference. Thank you for your commitment and knowledge that you share with us all.

Bettie

Thanks Bettie,

One thing I really appreciate is that you were one of the first people to sign up for the course and willing to take a chance on me.

Hi Steve,

In a nutshell, I agree with everything you’ve said. Blogging can seem a bit masochistic at times, and it’s definitely a long term pursuit, but the intangible benefits are huge, and well worth it. Congratulations on clearing six figures!

Cheers,

Tom

Hey Tom,

Yep. It can be a grind but these days it’s much easier now. Plus… I have you:)

Steve,

Starting a business can be a lonely endeavor. Not only do you help people take charge of their lives, but you also provide the practical community support that is so needed. The overwhelming voice that I’ve discovered throughout this blog is that of companionship, of which I believe your success is a reflection. Thanks for such quality thoughts and work.

Tony

Thanks Tony,

Speaking of which…haven’t seen you in office hours lately. How’s progress going with your store?

Steve,

I attended the Blog World conference in NYC last month, and with only one exception, every speaker said that it’s the third year when the money finally rolls in. It’s definitely not a get-rich-quick method.

Having said that, as a blogger (for both a brick-and-mortar regular job) and on my own (my travel blog will go live in 2 weeks) I feel like its the kind of endeavor that really serves to connect my real life with my working life in a meaningful way. When I’m writing, I get to infuse my thoughts and creativity into my work every single minute. And occasionally feel like I’m offering information that will help (or at least entertain) people.

I hope that’s how this blog works for you in your life, because you are certainly impacting many lives around you in a positive way every day.

One final thing: though I usually hate to be lumped in with the 95%, your blog is how I found your “Online Store” course. I’d been reading it for 4-5 months because the great content connects well with my readership at work (small business owners). When I decided to attempt an online business, there was no hesitancy to shell out the money for the course because I knew you were a smart, legitimate authority on the subject. Your blog also served as the best possible advertisement to my husband, who was really skeptical at first. The course has already started to change our lives.

Congrats on the financial success with the blog! You absolutely deserve it.

Hi Catherine,

I didn’t realize that the 3rd year was the magic point. A lot of bloggers I know started taking off after just a year.

BTW, there’s nothing wrong with the 95%:) Everyone’s doing it:) Very happy to have you in the class. See you in office hours tonight!

Hi Steve,

I love that it took you three years to really see some results. It gives me hope that persistence will pay off as I’m almost at the three year mark with my own blog.

I’m actually following a similar track to yours, but a bit more niche than what you’ve chosen to blog about. I created a niche blog about a particular shopping cart software, PrestaShop.

I wound up in that niche because my wife’s spa needed a shopping cart I got pretty good at using it.

After that experience, I set up an store for myself to sell jams and jellies, which has been a flop. I’m working on getting through your videos in the hopes that I’ll come up with a new idea for my next e-commerce store.

I have to admit that I’m really struggling trying to determine what I should sell, but I’ll keep at it until I come up with something.

I really appreciate all your very informative videos. Keep up the good work.

By the way, your program is so good, I recommend it to my subscribers.

Curt Donohue

http://www.prestatraining.com

Hey Curt,

Awesome! I’ve evaluated prestashop in the past and I think it’s a great cart and a good platform with which to establish a blog around. If you are coming around 3 years, that means that hopefully you will reach that tipping point soon as well. Thanks for the kind words!

Steve, it is 100% because of your blog that I started my online business two years ago. I can’t thank you enough for all of the advice and recommendations. Keep it up!

Hi Nicole,

Wow, I had no idea. I really appreciate the fact that you are a regular commenter on the blog as well. Thanks for the support!

Steve,

You’re right about it not just about being for the money. I love blogging and making money online. I love writing a post and seeing how my readers are going to react. I love getting emails from people that have taken action and have started to build their own income online.

I love this job!

Keep up the great work.

Hey Mike,

Thanks for the note. Going to checkout your blog right now.

That’s awesome to hear Steve! Your blog is the reason I’m starting my own business, before I would have never had the guts to even try! 🙂 So thanks for the encouraging and informative content — you really are helping a lot of people. Thanks and keep it up!

Mariana

Thanks Mariana!

I’m looking forward to critiquing your shop once you’ve launched!

There are so many factors that will dictate success.

I have a friend who started out 2 years ago with another friend with the same type of blog. MY friend has made about $50 a month average up until recently. HER friend is making over $50k a month and moved from Cali due to Amazon’s rules. The difference: research, dedication and finding what readers wanted.

Congrats that you “made it” and are doing well. I can be hard but if it’s your passion to blog about what you like, then the money is a bonus.

Keep it up!

Billie…this is a great point and comparison…there are so many variables that make the difference…but you hit the nail on the head with your points I think.

Thanks!

Wow. 50K a month is some crazy earnings for a blog. Is your friend a super Amazon affiliate?

Steve,

Thank you for this blog. I can probably gather the same information elsewhere, but your blog has saved me a lot of time in finding the right information. Most importantly, each time I read your blog I feel a kick into my ass for motivation. Keep up the good and hard work.

– Vince

Hey Vince,

Thank you for your message. It makes me happy every time I see a comment like this.

Wow, congrats on the income and slow but steady success! I just wanted to stop by and let you know you have a loyal reader.

Hey Robert,

Really appreciate the comment and thanks for being a loyal reader!

Congrats on the income! Most people say that blogging is the easiest way to make money, but they fail to realize that it doesn’t necessarily mean it’s the fastest; and you just backed that up. Still, you succeeded; and kudos to you.

Good stuff Steve!

Thank goodness for the internet in allowing us to do what we like, and make a good income doing it!

S

WOW that is amazing story big ups for your success you deserve it.

You said your blog exceed 6 figures in income

So you are saying you are making 1 mil a year from that blog?

I would guess the majority of that is selling your book/course?

THANKS!!!!

Hi Steve,

Your story is very uplifting and also encouraging to online entrepreneurs like myself. I was just wondering you say that your blog itself makes well over six figures, Is this just the blog itself or are you including your Create a Niche Online Store product in this income report as well?

Thank you

Hi Jedith,

Yes, this includes course sales. Was this not clear in the post?

It was not too clear from reading the post in the beginning perhaps I was reading too fast. But it is fairly clear underneath the title ‘Is Blogging Worth It?” However great article =)

Loved the ride, inspirational and spiritual, keep up the great work man. Wish you all the best for the future.

Hi Steve, Have been reading your emails & information for sometime and enjoy just about every word. So from what you are saying the way to go and earn money on the internet is with a ecommerce store. Have saved all of your emails, but can you tell me the best palce to start. Jay

Hey Jay,

The answer to that question depends on your goals. Check out this post. https://mywifequitherjob.com/blog-vs-niche-affiliate-site-vs-online-store/

Quick note to everyone, sent Steve a message few moments ago and he replied back almost before I had let the ink dry.

My hat is off to this guy.!!!

Jay

Hi Steve! I’m new to your site but am loving what you have to say 🙂

Just went thru a recent downsizing at work and ….well…need a new career! I’ve been a bricks & mortor service buisness before and did exceptionally well. I really want to be back in business for myself but do not want employees and would love a “location independent biz”….I’ve signed up for your free,intro course and look foward to learning from you (I came here thru Twitter!).

Will begin catching up on your articles this week!

Looking forward to getting to know you 🙂

Carol

What a great blog you have here! Your writing is top notch. And I can hardly believe the massive amount of resources and articles you have. This is my first time visiting (found you on BizSugar.com) and I plan to spend more time here learning from you.

Thank you for your hard work!

Hey Steve,

I love your writing style, and I can tell why people keep coming back to your site. You are right about blogging, you have to do it if you are passionate, money is only a positive result to the passion that you have put into a blog.

I have also created a small blog on which I write because I simply love to write 🙂 I have never thought of monetizing with it.

Thank you for the great write-up!

nice post as always, you really covered quite a bit, appreciate it! cheers! 🙂

I`am a new comer in blog. And I hope to make a good relationship with other bloggers. I hope we can be a friend in the future.

Hi Steve,

Nice post.. My dad referred me to your blog and your website.. I am also an entrepreneur based out of India and I also blog. New entrant and novice you can say :P.. http://rohan-nukoe.blogspot.in/ this is my blog.. Looking forward to connect with you and get some tips..

Can’t agree more with the write-up that there is more than just generating income through Blogging. Yes, Blogging makes relationships. I completely agree. That’s the beauty of Blogging. I’ve been a Corner Trader blogger for quite sometime. Yes, it has generated handsome money for me. But most of all. It has helped me get tons of friends and with some of them I have strong bonds, with whom I hang out regularly. That’s the real beauty of blogging.

Great to see this kind of honest blogging. I’ve struggled with the decision to launch a couple of blogs for a while. I’ve provided content to the financial services industry for years but always wanted to reach people personally. A lot of people are misled by other sites that tout how ‘easy’ blogging is and how much money one can make just to support the site’s training courses.

Thanks to Steve for telling it like it is and offering the right tools to new bloggers like myself. With the advice from this blog, I’m finally ready to launch. It won’t be easy but at least I know that perseverance pays off.

Thanks again,

Joseph Hogue

This is really inspiring. I’m still in the very early stages and I’ve decided to take a slower approach to writing blog posts, but have found some very small success. I’m looking forward to learning more along my journey!

A great entry. I also do not have a light pen in writing my blog and also sometimes I have to push myself, but I hope, the effort will pay off. I like your post, your sincerity, running a blog it is not such an easy thing especially at the beginning. Good luck at the next entries.

Thanks for sharing nice post as usual

Another awesome post. The more I explored your blog, the more interesting and useful I found it.

I want to start an eCommerce online business. But I still have a problem with which niche to use.

The 2 niches I’m looking at are Robots (Like – https://www.amazon.com/Sphero-Star-Wars-BB-8-Droid/dp/B0107H5FJ6/ref=sr_1_7?ie=UTF8&qid=1471966571&sr=8-7&keywords=robot) and winter sports products.

I took robots as a choice because It is an upcoming industry now

I need an expertise advice on choosing 1 niche to build my site

Thank you very much for your advice

Honestly speaking anyone can make with thousand of dollars with blogging.

But, there are soo many things anyone should do before able to earn thousand of dollars in month.

Affiliate Marketing is a good way to earn online. Niche is very important in Affiliate Marketing, Its like a seed of affiliate marketing strategy.

Hi Steve,

What is the template for your blog? Did you get help from a professional to create the layout etc of your blog?

Thanks

Isaac

Amazing success, congratulations. It’s a great motivator and a reminder to keep working hard, thanks for being so honest in your posts. I really love the new design of your ecommerce site. Looks great!

Steve!

I really find your writing overall motivation and extremely helpful!

I started a store selling private label products myself and it worked (that’s before I found you). Now we consistently get 50k of gross revenue a month and we only sell in Spain.

About blogging though, the fact that you made slow progress in the first years just mean that you followed the wrong strategy e.g. your one post/week policy.

You’d have easily gained success earlier by putting out content consistently more times per week (like many youtuber’s daily videos) and doing webinars to build your list.

With that said, this requires a lot more time and effort, so obviously this is for the most committed with a lot more free time (not people with full time jobs like you were ).

Posting one piece of content a week and then marketing it is also a sustainable way in the long term and will generate results once you accumulate enough content.

With that said, I just started by website, I plan to use youtube and webinars and written content mainly to build my following, and then I’ll make video courses to monetize it. Same niche as your blog. 😉

Like your blog post. Really helpful, motivated and valuable information. Recently started my blog about finance and life. I will learn about blogging more from your blog. Thanks for sharing

Hi Steve,

What a relief to find someone like you who explains it fully. Thanks so much. You make sense and are very positive.

Patrick

Hello Steve,

I like the comparison between an blog or a online store. Your right about starting a blog first. I learned my lesson the hard way and started a store with no online experience. Thanks for the good post!

Wow, what you did is extremely inspiration. I became a blogger not too long ago. I’m still trying to figure out the best way to pitch my story and blog post.

Do you have any blog post on that?

Great comparison. I started my blog a few years ago. Haven’t put too much effort into it until late last year. Now I’m looking into an online store so I think your 6 day course might really help me out. I just signed up for it so I’ll let you know in several months how it goes!

Hello Steve,

I hope you are doing well, my name is Larbi and I have been trying to reach out to you few time but to no avail. I am interested in starting to sell on Amazon, however, I don’t know where to start. I am looking for a proven blueprint (I can’t trust anymore for some reason) after I listen to your podcast I found out that you are a genuine person who is willing to help others achieve there dreams.

PLEASE please reach back to discuss if there is any blueprint that you are selling that can helping generate some passive income. I am also a digital content producer if you need any help I will be able to help

Thank you

Larbi161@msn.com

571-275-2390

Thanks for sharing your honest experience. When I first took a look at my headshots,

I wasn’t too thrilled with mine but you’ve given me a new perspective!

I appreciate the shout out in your article too!

This is absolutely a spot on article for myself. I’ve been wanting to start something of my own but unsure where to start, so thanks!

I have a couple of questions for you:

-can I have ads on my WordPress site? I heard WordPress is a bit more restrictive than a normal site?

-what’s your thought on running a site that sells digital products and running a blog at the same time as a first-timer? My husband and I work full-time but we don’t have kids yet.

Look forward to hearing from you soon and keep up the good work!

Cheers,

Elaine

Another way of making money blogging is Flipping them for a huge profit. After monetizing a blog with Affiliate programs / adsense. Work towards flipping it and get a huge profit at once. However, earnings & traffic are supposed to be stable.

This is a great post, I loved it

i have not made a single dime! since i started blogging for 4months now

Blogging is so much a hard task

Remember to provide value to your audience. Educational, informative, or entertaining.

Do reveal ‘dark’ and hidden secrets on your blogs as well 😀

Blogging is very lucrative and i think i will stick with it

You need money, patience and time to succed in bloggin

Blog Blog Blog

I have a wordpress blog

Blogger vs WordPress

I will choose wordpress anyday

Blogger is still cool but..

Npower salary is bae

interesting piece of article

WordPress is very easy to use with the help of plugins

use of plugins makes wordpress easy

blogging gives alot of money but, it pays over time

Get all news in our website

Nice, very informative blog about the characteristics of different business models for making money online. You should check out StoreHippo which has a very wholesome CMS to build a good blogging website for you. No matter what business model you are following, StoreHippo can help you with them all.

My question is this… I am looking for a Chinese supplier to send gifts to students in China so buy in China ship in China. It is too expensive to ship from here and of course the product is cheaper there as well. Any suggestions? I want to create a website where online teachers can purchase a gift for their students in China and it be sent in China to avoid high shipping costs. Does this make sense?

Thanks so much for posting your income reports. I just started a personal finance blog and find these very helpful and inspirational. I can’t believe you made $1.4 million in 2017! That is my goal.