In this post, you’ll learn why you should avoid Stripe payments to process credit cards for your online business. Here’s my story.

First off, I want to come out and say that I love Stripe as a product. Their signup process is easy and they have the best credit card processing API in the industry.

Most applications support Stripe out of the box and they provide libraries for geeks like me who like to code custom functionality into their websites.

Compared to other payment processors that I’ve worked with, I can wholeheartedly say that my experience with Stripe has been great and I was happy with them for 10 straight years!

But then the troubles began…

Get My Free Mini Course On How To Start A Successful Ecommerce Store

If you are interested in starting an ecommerce business, I put together a comprehensive package of resources that will help you launch your own online store from complete scratch. Be sure to grab it before you leave!

My Stripe Payments Story

For those of you who randomly stumbled upon this post, I run an ecommerce store selling handkerchiefs, and an online membership site that teaches ecommerce.

In addition, I document my experiences running my businesses on my blog, my YouTube Channel, podcast and social media.

All of my businesses use Stripe to some capacity and my online membership site relies on Stripe to manage subscriptions and installment payments.

Recently, my websites have been attacked by scammers using fake credit cards to checkout.

Here’s how the scam works.

- Scammer has a bunch of illegal credit cards but they are unsure which ones are valid.

- Scammer tries illegal credit cards one by one on your website.

- When they find one that works, they use it to buy illegal merchandise.

- The victim of credit card theft files a chargeback for all illegal transactions.

I’ve been using Stripe for 10 straight years without a problem. And while I get an occasional chargeback, it’s usually quite rare.

But a string of unfortunate events caused me to get several charge backs within a short period of time.

In all cases, the customers did not contact me at all and simply had the charges reversed. When I took a closer look at these cases, here’s what I found.

One dispute was from someone who was beyond the return policy and decided to file a chargeback without contacting me.

Another dispute was from someone who was likely the victim of credit card fraud.

Another dispute was from a customer who thought that he was purchasing my $1799 product for only $99.

This customer did not contact me at all and I would have happily given him a refund. But the end result was several chargebacks in a short period of time.

Shortly after, I received an email from Stripe indicating that I’d been suspended and my funds held.

Here’s the email.

Hi Stephen,

We’re writing to let you know that, after conducting a review of your business, we’ve found that it presents a higher level of risk than we are able to work with at this time.

Transitioning off Stripe:

We understand that moving away from Stripe can take time, so your service is not ending immediately. To help with the transition to a new payment processor, we’re able to provide you 5 additional days (beginning today) to switch to a new provider. After this time, you won’t be able to accept charges on your account.

Because of the elevated risk associated with your account, your balance will be placed on reserve for the next 90 days (the industry-standard period during which most payments are disputed). During this time, the reserved funds will help cover any disputes or unforseen refunds on your account. The remaining balance will be paid out to your bank account at the end of this period.

— The Stripe team

What Happened Next

Ironically, I didn’t freak out when I received this email because I thought that I would be able to clear this up pretty quickly.

After all, I’ve been on Stripe for over 10 years and this was just a temporary blip.

But I was wrong.

I received a response that my appeal was denied and that I only had 5 days to transition my entire membership site to another payment processor.

ONLY 5 DAYS!

As an engineer, I always plan for the worst so I immediately started researching different payment processors when I realized the magnitude of the task ahead of me.

You might not think that transitioning a 7 figure business to a different payment processor is that difficult. But it’s a HUGE deal when you run a membership site.

Here’s what’s involved.

- You have to learn an entirely new API from a different payment processor and implement the code on your site.

- You have to test the code thoroughly to make sure it works properly.

- You have to reach out to ALL of your subscribers and have them enter their payment information again.

There’s NO WAY that this can be accomplished in just 5 days.

In any case, because my appeal was denied and I didn’t want my million dollar business to crumble, I decided to ask for an extension.

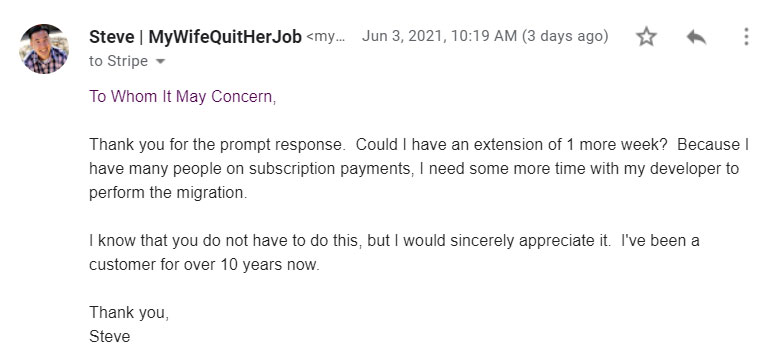

Here was the email I sent.

In my email, I mentioned the word “developer” in the 3rd person, but I’m the developer! I do all of the coding for my businesses and I knew that I was screwed!

Because I’ve been on Stripe for 10 years, I expected Stripe to give me a tiny bit of time to migrate and I only asked for a week.

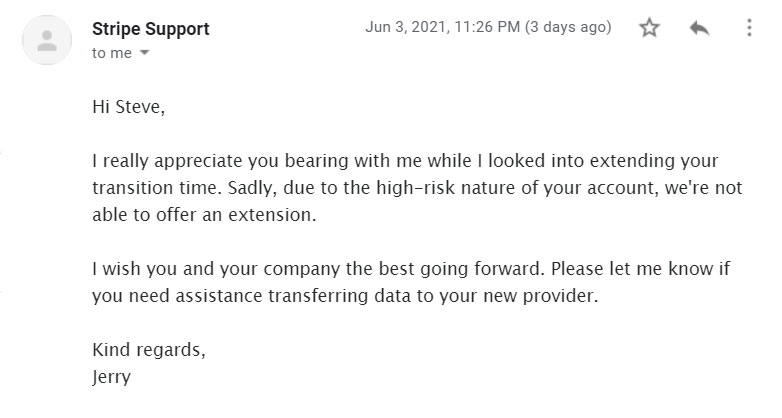

But here was the response they gave.

To provide some additional context, my son recently graduated and I was supposed to attend one of his graduation parties which I had to skip to code up a new payment processor.

What I didn’t appreciate was Stripe’s BS reply to my extension request. If I was too great of a risk, why was I not discovered 10 years ago?

By the way, in case you are sensing anger in my writing, rest assured that I’m not angry. I just feel that this behavior from a major company is unacceptable.

I run a well respected online membership site that teaches ecommerce and I’ve been doing so for over a decade now without any problems.

In fact, MyWifeQuitHerJob.com is a well known blog in the ecommerce space and my podcast is a top 25 show in marketing in all of iTunes.

Why You Should Avoid Stripe

In any case, this incident made me realize how fragile your business is if you use Stripe as your main payment processor.

If all it takes is a few chargebacks to take your business down WITHOUT any recourse or explanation, then you should not be using it!

For example, it would be extremely easy to get any business banned from Stripe. All you would have to do is organize a small chargeback ring and orchestrate multiple simultaneous disputes!

For the record, I never expected Stripe to suddenly cancel my account without warning and without any chance for an appeal.

It’s one thing if I just started using Stripe, but I’ve been a loyal customer for over 10 years! Most businesses don’t even last that long!

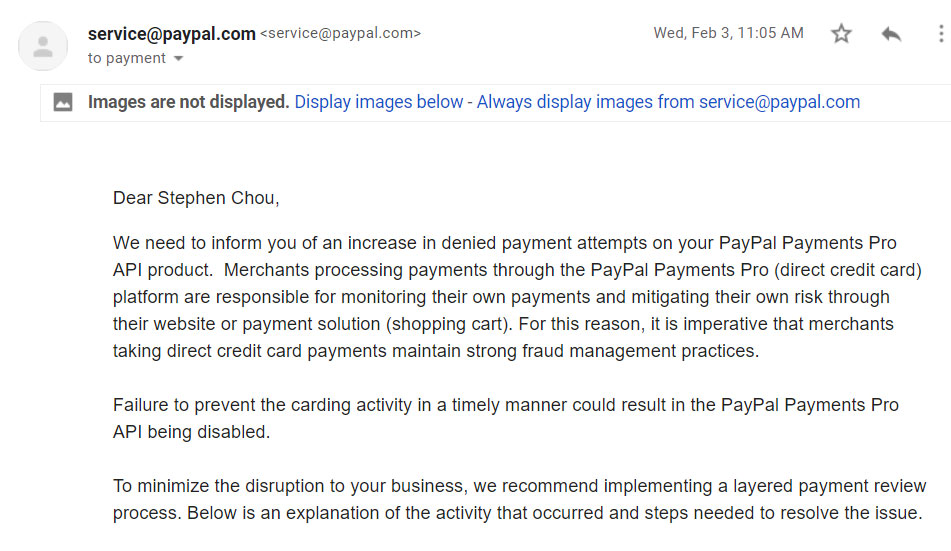

To provide a counter example, when my ecommerce store was attacked by credit card spammers, Paypal kindly sent me a warning to fix the issue.

Because I received a warning, I was able to take immediate action and fix the problem. You know we live in bizarro world when Paypal sends you a warning and Stripe does not!

My Advice When Considering Stripe

If you do a simple Google search online for “Stripe Sucks”, you’ll find many complaints about Stripe and their poor customer service practices.

Whenever I read a post written by a random person, I always take it with a grain of salt and you should do the same with this article.

But consider the facts.

I’ve been using Stripe to process many millions of dollars of payments for the past 10 years.

I’ve never had a problem with excessive chargebacks before.

Stripe has every right to not let me use their service but they should have provided some warning before shutting down my 7 figure business.

They could have given me advice on how to minimize the fraud and how I could have changed my policies. They could have given me a warning like Paypal did for my ecommerce store.

To make things even worse, their customer service is curt and unsympathetic. To demand a complex migration in just 5 days is ridiculous!

This is a text book case study of how not to handle customer service for a billion dollar company.

Bottom line, your business is fragile if you depend on Stripe. The problem with Stripe is that it’s a great product and easy to use but their customer service is lacking.

Here’s my advice.

If you decide to use Stripe out of convenience, make sure you have a backup payment processor ready to go. Because at some point, you will get banned.

It might not be in a year, 5 years or even 10 years! But it will happen. And when it does, you will be screwed.

What’s Next For My Business?

After reading all of the Stripe horror stories online, I immediately migrated my membership site to a different payment processor.

But I’m lucky because I know how to code.

Can you imagine if you ran a business and didn’t have anyone technical to turn to? If you don’t know how to code, you could easily be down for weeks if not months when Stripe suddenly shuts you down.

All told, it took me 4 straight days of programming to migrate my site over to a different platform.

Meanwhile, I had to miss my son’s graduation and the other activities I had planned for the weekend. In addition, the experience was extremely stressful.

Anyway, the purpose of this post is not to vilify Stripe but to make businesses aware of how fragile Stripe can make your business.

If all it takes is a few consecutive chargebacks to bring your business down, you may want to reconsider.

Coming from the Amazon selling world, there are tons of scammers out there and many paid services available to sabotage your competitors.

Can you imagine if a service existed to file chargebacks en masse? You business wouldn’t stand a chance!

Stripe needs to change their customer service practices and at a bare minimum, provide a little more runway for a complete migration.

Ready To Get Serious About Starting An Online Business?

If you are really considering starting your own online business, then you have to check out my free mini course on How To Create A Niche Online Store In 5 Easy Steps.

In this 6 day mini course, I reveal the steps that my wife and I took to earn 100 thousand dollars in the span of just a year. Best of all, it's free and you'll receive weekly ecommerce tips and strategies!

Related Posts In Case Studies

- Gorgias Review – How To Cut Customer Service Costs By 30%

- How I Made Over $300K These Past 2 Years With An Email Autoresponder

- Amazon Advertising: Is Hiring An Agency Worth It? (Case Study)

- Hiring An Accountant To Do Your Taxes Vs Using Turbo Tax Or Tax Cut

- Web Design And Development – 7 Tweaks That Drastically Increased Our Online Store Sales

Steve Chou is a highly recognized influencer in the ecommerce space and has taught thousands of students how to effectively sell physical products online over at ProfitableOnlineStore.com.

His blog, MyWifeQuitHerJob.com, has been featured in Forbes, Inc, The New York Times, Entrepreneur and MSNBC.

He's also a contributing author for BigCommerce, Klaviyo, ManyChat, Printful, Privy, CXL, Ecommerce Fuel, GlockApps, Privy, Social Media Examiner, Web Designer Depot, Sumo and other leading business publications.

In addition, he runs a popular ecommerce podcast, My Wife Quit Her Job, which is a top 25 marketing show on all of Apple Podcasts.

To stay up to date with all of the latest ecommerce trends, Steve runs a 7 figure ecommerce store, BumblebeeLinens.com, with his wife and puts on an annual ecommerce conference called The Sellers Summit.

Steve carries both a bachelors and a masters degree in electrical engineering from Stanford University. Despite majoring in electrical engineering, he spent a good portion of his graduate education studying entrepreneurship and the mechanics of running small businesses.

What an awful experience, I have Stripe connected to my WooCommerce store. Paypal may be my only other alternative. Not sure if there are others?

Timely post. My developers are about to start coding for the Stripe interface. I think I will have a chat to them about alternatives