If you are starting an online store, the idea of importing goods from Chinese suppliers can seem intimidating. There’s paperwork involved, and even a small error can lead to a hefty fine from the Customs Border And Protection Agency.

But clearing customs is relatively easy as long as you know what documents are required and which fees to expect.

In this post, I’ll explain what you need to know about customs clearance, including the terminology, paperwork and costs.

Are you interested in creating a strong, defensible brand for your products? If so, I put together a comprehensive package of resources that will help you launch your own online store from complete scratch. Be sure to grab it before you leave!

What Is Clearing Customs?

Clearing customs is the process of submitting documents and paying applicable duties or tariffs to the relevant authorities when importing or exporting goods.

All countries have their own agencies to facilitate the customs clearance process. In the US, the customs agency is US Customs and Border Protection (CBP), and in Canada, customs clearing is handled by the Canada Border Services Agency (CBSA).

The primary goal of the customs agencies is to protect the country’s revenue and ensure proper duties and taxes are collected. The agencies also protect the country’s borders from smugglers and terrorists.

What Is The Customs Clearance Process When Importing In The US?

There are three steps to the customs clearance process when importing goods into the US: filing for the release of goods, completing the “CBP Form 7501 Entry Summary”, and paying duties.

Step 1: Filing For Release Of Goods

You have 15 days to file for a cargo release when your shipment arrives at the port. The goods are stored at a terminal until you file for their release.

You won’t be charged a storage service fee for the first two to five days. After that, you may be charged a fee depending on the port of entry.

Step 2: Filing The “Entry Summary” Form

The US Customs and Border Protection needs importers to fill out the CBP Form 7501 “Entry Summary.”

The entry summary form includes a declaration, which consists of the origin, classification, and value of the imported goods. It must be filed within ten days of the cargo’s release from the customs agency’s custody.

Step 3: Paying Duties

Once a customs official approves your paperwork, they’ll check if you selected a DDU (Delivered Duty Unpaid) or a DDP (Delivered Duty Paid) service.

You’ll be asked to pay outstanding duties depending on your International Commercial Terms (Incoterms).

Check with the port what mode of payment they accept. Most ports don’t allow credit or debit cards and accept only check or cash.

Once all the taxes and duties are paid, the customs agency may randomly subject the cargo to an intensive exam, following which they will release your shipment.

What Is The De Minimis Level?

The De Minimis level is a value below which importers aren’t required to pay duties or taxes and are allowed a faster customs clearance process.

All countries have a different De Minimis level. In most countries, the De Minimis level is below $100. However, the De Minimis level is $800 in the US and $150 in Canada.

What Are HS Codes?

The Harmonized System code, or HS code, is a six-digit code used to classify imported and exported items globally.

HS code, also known as HS numbers, is used by customs agencies worldwide to identify duties and taxes for specific product types.

Since the HS code is a universal classification tool, it is recognized by most countries worldwide. But many countries add additional digits to the HS code to distinguish items in certain categories.

The US also has its own classification system called the Harmonized Tariff Schedule (HTS) code, where four more digits are added after the six-digit HS code.

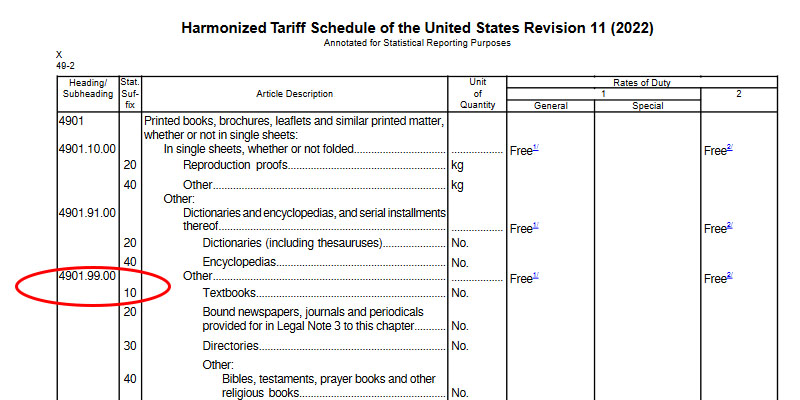

Here’s an example that breaks down the HS code and HTS US code:

- 4901.99.00.10: This is the complete HS code.

- 4901: This number is called a “Heading” and is assigned to a specific category.

- 99: This number is a “Subheading,” which defines a subcategory of a product.

- 00: This number is a tariff item explicitly set by the US.

- 10: This is a statistical tracking number explicitly set by the US.

The first six digits, “4901.99,” is the HS code shared by all countries, while the last four, “0010,” are set by the US only, which is why you must check country-specific HTS codes or the last four digits.

You can use the Schedule B Search engine to determine product classification codes if you’re importing goods to the US.

What Documents Do You Need For Customs Clearance?

When importing goods to the US, you’ll need a commercial invoice, packing list, certificate of origin, bill of lading, and a summary entry form. Let’s take a close look at each document:

Commercial Invoice

Your supplier provides a commercial invoice showing itemized details of the products you ordered and the price you paid.

Since you’ll be importing goods to the US, the commercial invoice must also contain detailed information such as the place of purchase, company details, and the address to which the goods are being shipped.

Packing List

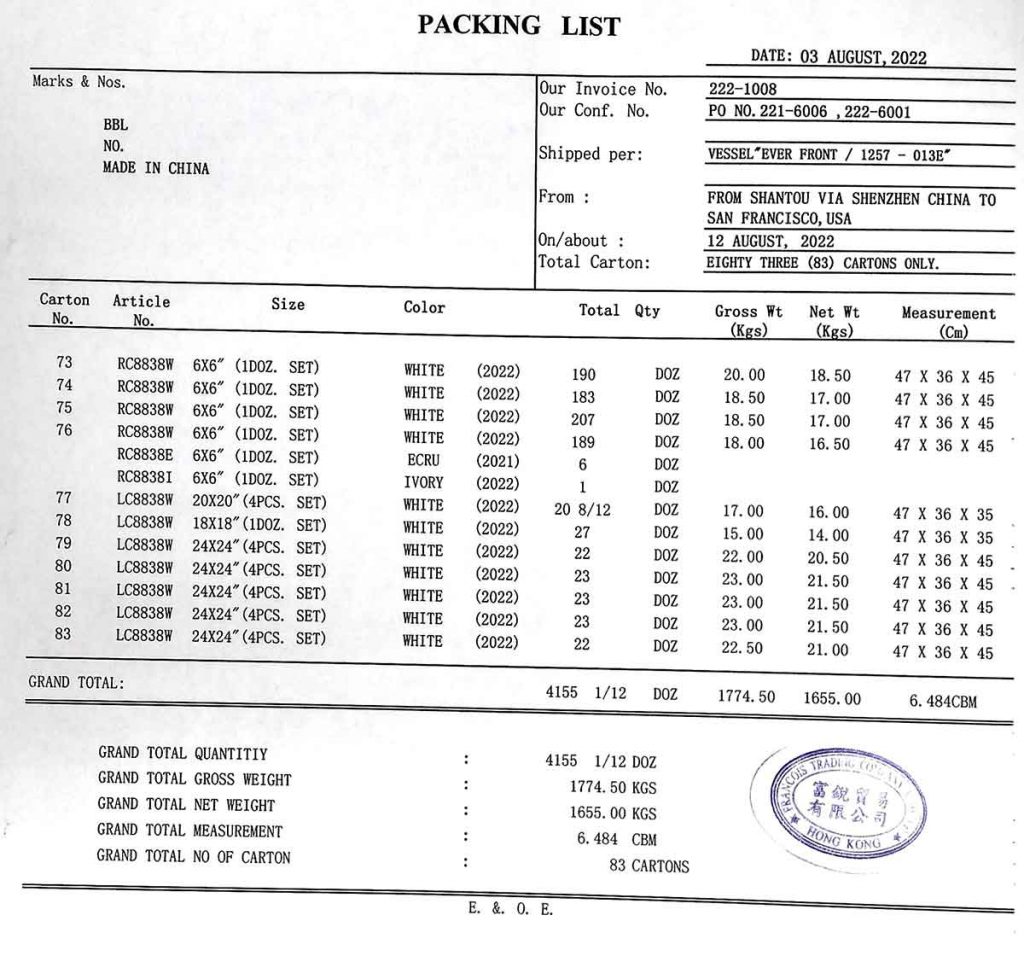

The shipper or freight forwarder supplies a packing list, which includes details on shipment contents, seller information, invoice details, product weight, and container numbers.

Certificate Of Origin (COO)

The certificate of origin document declares the country where the products are manufactured. The COO helps customs officials decide if special import duty is applicable or if the goods qualify for import duty exemption.

Bill Of Lading/Airway Bill (BOL or AWB)

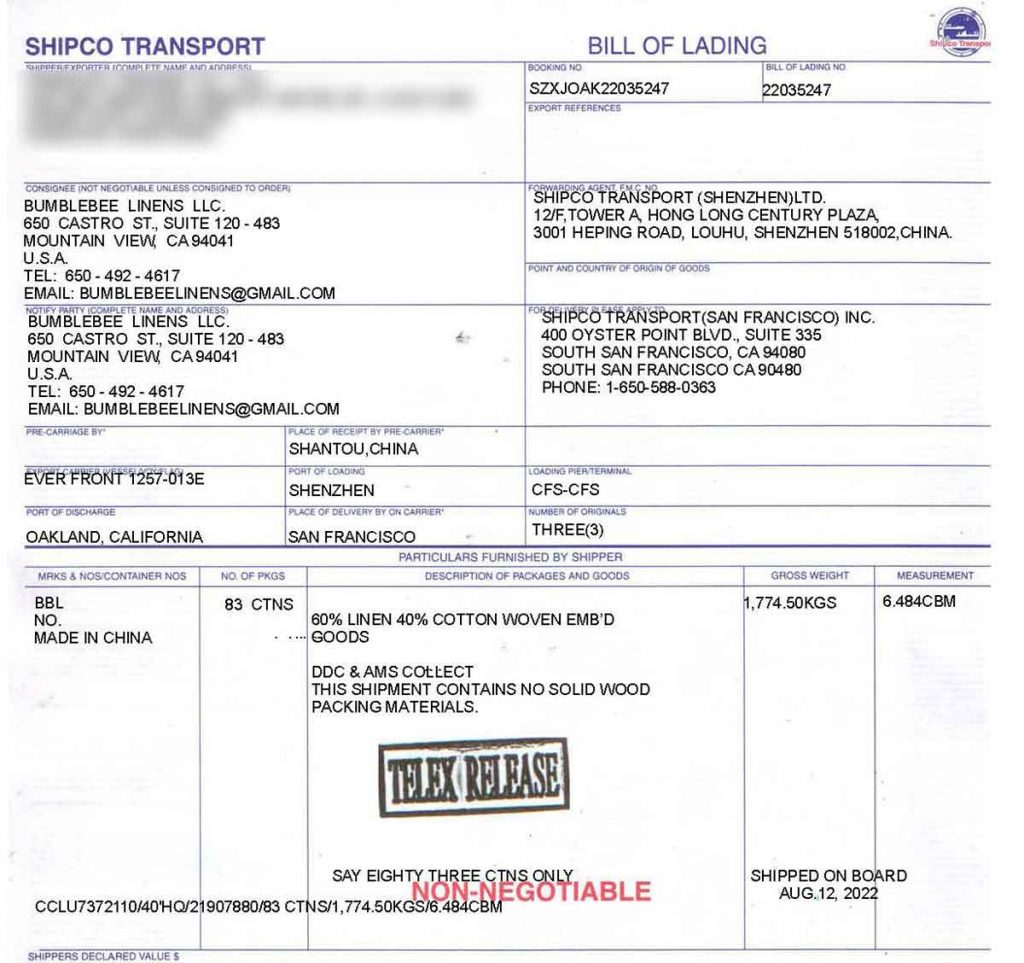

A bill of lading is a document the freight carrier provides with product details and their destination.

The document is called an airway bill or AWB when these goods are shipped via air.

CBP Form 7501 “Entry Summary”

The main customs clearance form is the CBP Form 7501 “Entry Summary.”

The entry summary form contains all the relevant information about the product, its classification, country of origin, importing carrier, mode of transport, importer number, and port code.

Miscellaneous Documents

You may also require cargo control documents for goods with special permits and memorandums.

For example, you may need permits from the Food and Drug Administration (FDA) or the United States Department of Agriculture (USDA) for certain foods and drugs.

How To Calculate Customs Clearance Costs?

Your customs clearance costs will consist of merchandise processing fees, harbor maintenance fees, import bond premiums, import duties, inspection fees, and fees to various regulatory agencies. Here’s a breakdown of each:

Merchandise Processing Fee (MPF)

The merchandise processing fee is 0.3464% of the cost of products as entered on the commercial invoice. The minimum MPF charged is $27.23, and a maximum of $528.33.

Harbor Maintenance Fee (HMF)

The Harbor maintenance fee is 0.125% of the cargo value declared on the commercial invoice. HMF applies only to goods that enter the US via ocean transportation.

Import Bond

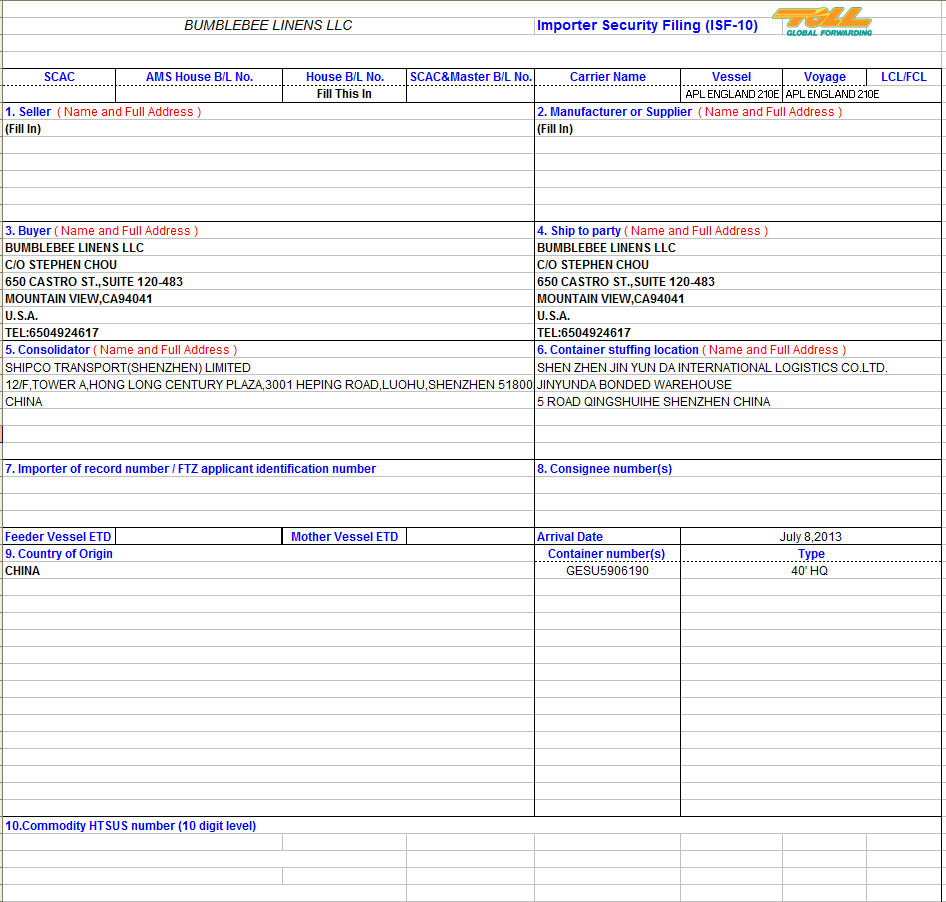

A surety company pays an import bond premium to US Customs on your behalf to guarantee that you’ll submit the Importer Security Filing (ISF) form on time and pay all applicable import duties.

ISF, also known as “10 + 2,” is required for all ocean cargo imports to the US. Your ISF must be filed at least 24 hours in advance of your cargo leaving port from the original destination.

If you regularly import into your country, you can pay for a continuous bond that covers all custom entries in a year. An import bond is at least 10% of the total duties and taxes paid.

For example, an import bond for $50,000 worth of total duties paid can cost you around $500.

Import Duties

Import duties depend on the HS code and the country of origin. Products from certain countries like Jordan, Chile, Canada, Mexico, and Singapore can enter the US at a reduced or duty-free rate.

Shipments from China to the US may be subject to additional tariffs.

If a shipment has multiple products, CBP charges import duty separately for each product.

Inspection Fees

The US customs agency inspects shipments randomly and charges a fee for them. For example, a simple x-ray inspection can cost you around $300.

If CBP conducts an “intensive examination,” the fee could increase to $1000 or more.

Regulatory Agency Fees

If the imported goods are regulated, you may need to obtain a license or register with the relevant government agency, such as the Environmental Protection Agency (EPA) or FDA.

If you’re still unsure how much it will cost to import your goods, my Real Cost Of Goods Import Calculator can give you a rough estimate.

How Long Does The Customs Clearance Process Take?

Typically, the customs clearance process takes less than 24 hours. However, the processing time can be delayed by several days or weeks if paperwork is incorrectly drafted or if your goods require additional inspection.

Shipments below the De Minimis level often clear customs immediately.

When Should The Customs Clearance Paperwork Be Filed?

You can file the customs clearance paperwork anytime within a week before cargo arrival to no later than ten days after arrival.

Ideally, your goal should be to clear customs before your goods arrive so the shipment reaches its destination without delays.

It’s best to check with your customs agency to find out when you can file the paperwork because some countries only process customs clearance once the goods are dispatched or have arrived.

For example, Importer Security Filing must be submitted at least 24 hours before the cargo is loaded onto the ship to the USA.

Common Mistakes In The Customs Clearance Process

Three common mistakes in the customs clearance process include not providing proper incoterms, incorrect HS codes, and late payment of duties.

Incorrect Incoterms

Incoterms are internationally accepted shipping and trading terms for commercial use. Some commonly used incoterms are Delivered at Place (DPU), Ex Works (EXW), and Delivered Duty Paid (DDP).

Proper incoterms need to be assigned for a smooth import process.

Editor’s Note: If you’re sending your goods directly to an Amazon FBA warehouse, you must use a DDP service from your freight forwarder since Amazon refuses all inventory when the customs duties aren’t paid.

Incorrect HS Codes

Since HS codes decide the tariff duty you pay for your imported goods, you must use the correct numbers that accurately describe your products.

If you think more than one code describes your product, choose a classification code with a higher duty to avoid any issues arising from underpaid duties on the goods.

Alternatively, you can ask a customs broker for help or request an official classification from the customs agency.

Late Payment Of Duties

If you don’t pay the Customs and Border Protection Agency on time, they’ll issue a Notice of Penalty and a late payment fine. You’ll be charged an administrative fee of $100 and an interest rate of 0.01% daily after the CBP payment date expires.

If you continue to make late payments on your imports, you risk being placed on the US Customs Sanctions list.

Should You Use A Customs Broker?

You should use a customs broker if you’re a new importer of goods or want to avoid the headache of dealing with customs officials.

There are many obstacles to deal with, and a customs broker can guide you through the process and help clear your goods on time.

Customs brokers have the expertise and experience to fill out the required customs forms and overcome any hurdles your shipment can encounter.

A customs broker charges between $100-250 for their services.

How To Choose A Customs Broker?

Always search for a customs broker with experience in your industry who can handle your shipment volumes.

If you’re importing a specific product type like food, textiles, or electronics, a niche customs broker will be more helpful than a general one.

It also helps if your broker has the resources to work with a large volume of goods, especially if your business is growing quickly.

If you need help hiring a reliable customs broker, join my class where I offer a list of vetted references.

After finding the right broker, get a detailed quote, ensure you understand all the costs upfront, and ask any questions you may have before hiring them.

Using a customs broker won’t usually save you money, but it will save time, especially when you’re new to importing goods into the country.

How To Clear Customs: Final Thoughts

Whether you’re importing goods from China or another country, customs clearance can be overwhelming, but don’t let that stop you.

Follow the steps described above and ensure you have all the required documentation to clear customs without any issues.

If you’re still unsure how to clear customs, remember to ask for help from a broker or customs officer.

Ready To Get Serious About Starting An Online Business?

If you are really considering starting your own online business, then you have to check out my free mini course on How To Create A Niche Online Store In 5 Easy Steps.

In this 6 day mini course, I reveal the steps that my wife and I took to earn 100 thousand dollars in the span of just a year. Best of all, it's free and you'll receive weekly ecommerce tips and strategies!

Related Posts In How To Find Products To Sell

- Best 29 Wholesale Clothing Vendors In Los Angeles And The LA Fashion District

- Spocket Dropshipping Review – Plans, Pricing, Pros And Cons

- Jingsourcing Review – Is This China Sourcing Company Worth Using?

- How To Use Terapeak For eBay To Research Hot Items To Sell

- Doba Review: Easiest Way To Start Dropshipping For FREE

Steve Chou is a highly recognized influencer in the ecommerce space and has taught thousands of students how to effectively sell physical products online over at ProfitableOnlineStore.com.

His blog, MyWifeQuitHerJob.com, has been featured in Forbes, Inc, The New York Times, Entrepreneur and MSNBC.

He's also a contributing author for BigCommerce, Klaviyo, ManyChat, Printful, Privy, CXL, Ecommerce Fuel, GlockApps, Privy, Social Media Examiner, Web Designer Depot, Sumo and other leading business publications.

In addition, he runs a popular ecommerce podcast, My Wife Quit Her Job, which is a top 25 marketing show on all of Apple Podcasts.

To stay up to date with all of the latest ecommerce trends, Steve runs a 7 figure ecommerce store, BumblebeeLinens.com, with his wife and puts on an annual ecommerce conference called The Sellers Summit.

Steve carries both a bachelors and a masters degree in electrical engineering from Stanford University. Despite majoring in electrical engineering, he spent a good portion of his graduate education studying entrepreneurship and the mechanics of running small businesses.