Have you ever wondered how Amazon merchants selling $2 items can possibly make a profit? The truth is that they are not.

In fact, most sellers fail to calculate all of the Amazon seller fees and end up losing money as a result.

To make matters worse, Amazon doesn’t make it easy for you to calculate all of your costs and there are many hidden fees that Amazon doesn’t tell you about.

Because I’ve been selling on Amazon for many years now, I wrote this post to help you understand all of your costs including all unexpected Amazon seller fees.

I’ll also show you how to use Amazon’s FBA calculator and enumerate all of your Amazon FBA costs.

Are you interested in creating a strong, defensible brand for your products? If so, I put together a comprehensive package of resources that will help you launch your own online store from complete scratch. Be sure to grab it before you leave!

How Much Does It Cost To Sell On Amazon?

On average, Amazon FBA sellers have to pay a 15% referral fee, a monthly account fee of $39.99 for a professional account and an Amazon FBA fulfillment fee that ranges from 10-15% of your revenue depending on the size and weight of your product.

When you first sign up as a brand new seller, you must choose between 2 plans, Professional or Individual.

An individual seller account does not carry a recurring monthly fee. However, you must pay a $.99 closing fee for every item you sell on their marketplace in addition to a referral fee of 8-45% (The exact fee depends on your product category).

A professional seller account costs $39.99 per month but you don’t have to pay the $.99 per item fee like an individual seller. As a result, if you sell more than 40 items per month, it’s always cheaper to get a professional seller account.

Professional sellers also have to pay a variable closing fee that ranges from 8% to 45%. Most product categories, however, will cost you 15%.

How Much Are Amazon Referral Fees?

Amazon charges a 15% referral fee for most product categories on their marketplace and their variable closing fee is based on the product category and item price.

Some categories also carry a per-item minimum referral fee.

For example if you sell jewelry, the closing fee is 20% for the portion of the total sales price up to $250 and then 5% after that. There’s also a minimum fee of $.30.

When you sell on Amazon, you will always get charged at least the minimum per-item referral fee.

But in practice, the percentage fee (which ranges from 8% to 45%) will almost always be higher than the minimum per-item fee unless you sell low priced goods.

Because most product categories carry a 15% fee, many new Amazon sellers incorrectly assume a 15% fee by default.

Make sure you check the Amazon fee table below because some categories have Amazon seller fees as high as 45%!

Depending on what you sell, certain product types may carry a variable closing fee as well.

For example books, music, videos, DVDs, video games and software have fees that vary based on category, item price, shipping destination and the type of shipping service.

Here’s a complete list of Amazon referral fees for 2024 based on product category.

Note: If you are in the Amazon Launchpad program, you should add an additional 5% to the values below.

| Product Category | Referral Fee Percentage | Referral Fee Minimum Amount |

|---|---|---|

| Amazon Device Accessories | 45% | $0.30 |

| Appliances – Compact | 15% for the portion of the total sales price up to $300.00, and 8% for any portion of the total sales price greater than $300.00 | $0.30 |

| Appliances – Full-size | 8% | $0.30 |

| Automotive and Powersports | 12% | $0.30 |

| Base Equipment Power Tools | 12% | $0.30 |

| Baby Products | 8% for products with a total sales price of $10.00 or less, and 15% for products with a total sales price greater than $10.00 | $0.30 |

| Backpacks, Handbags, and Luggage | 15% | $0.30 |

| Beauty, Health, and Personal Care | 8% for products with a total sales price of $10.00 or less, and 15% for items with a total sales price greater than $10.00 | $0.30 |

| Business, Industrial, and Scientific Supplies | 12% | $0.30 |

| Clothing and Accessories | 5% for products with a total sales price of $15.00 or less 10% for products with a total sales price greater than $15.00 and less than or equal to $20.00 17% for products with a total sales price greater than $20.00 | $0.30 |

| Computers | 8% | $0.30 |

| Consumer Electronics | 8% | $0.30 |

| Electronics Accessories | 15% for the portion of the total sales price up to $100.00, and 8% for any portion of the total sales price greater than $100.00 | $0.30 |

| Eyewear | 15% | $0.30 |

| Fine Art | 20% for the portion of Sales Proceeds up to $100 (with a minimum Referral Fee of $1.00); 15% for any portion of Sales Proceeds greater than $100 up to $1,000; 10% for any portion of Sales Proceeds greater than $1,000 up to $5,000; 5% for any portion of Sales Proceeds greater than $5,000 | — |

| Footwear | 15% | $0.30 |

| Furniture | 15% for the portion of the total sales price up to $200.00, and 10% for any portion of the total sales price greater than $200.00 | $0.30 |

| Gift Cards | 20% | — |

| Grocery and Gourmet | 8% for products with a total sales price of $15.00 or less, and 15% for products with a total sales price greater than $15.00 | — |

| Home and Kitchen | 15% | $0.30 |

| Jewelry | 20% for the portion of the total sales price up to $250.00, and 5% for any portion of the total sales price greater than $250.00 | $0.30 |

| Lawn and Garden | 15% | $0.30 |

| Lawn Mowers and Snow Throwers | 15% for products with a total sales price of up to $500.00, and 8% for products with a total sales price greater than $500.00 | $0.30 |

| Media – Books, DVD, Music, Software, Video | 15% | — |

| Musical Instruments and AV Production | 15% | $0.30 |

| Office Products | 15% | $0.30 |

| Pet Supplies | 15%, except 22% for veterinary diets | $0.30 |

| Sports and Outdoors | 15% | $0.30 |

| Tires | 10% | $0.30 |

| Tools and Home Improvement | 15% | $0.30 |

| Toys and Games | 15% | $0.30 |

| Video Games and Gaming Accessories | 15% | — |

| Video Game Consoles | 8% | — |

| Watches | 16% for the portion of the total sales price up to $1,500.00 3% for any portion of the total sales price greater than $1,500.00 | $0.30 |

| Everything Else | 15% | $0.30 |

How Much Does Amazon Fulfillment Cost?

On average, most Amazon FBA sellers pay 10-15% of their revenue in Amazon FBA fulfillment fees.

Amazon FBA seller fees are broken down into 2 components.

- Inventory Storage Fees – Amazon charges a fee for storing your inventory based on the volume your products occupy.

- FBA Fulfillment Fees – Amazon charges a fee for picking, packing and shipping.

Amazon Inventory Storage Fees

Amazon charges an inventory storage fee of between $.56 – $2.40 per cubic foot based on your Amazon product size tier and the current month.

Here’s how Amazon storage fees are calculated.

- Product Size Tier – Amazon offers 2 main product size tiers, standard and oversized. Oversized products carry larger fees.

- Current Month – Amazon storage fees vary on a month to month basis based on peak shopping seasons.

- Product Volume – The volume of your products are measured based on your product’s size when fully packaged and ready to ship.

- Average Daily Units – Amazon storage fees are based on the average number of units stored in Amazon’s warehouse per month.

Here’s a table of storage costs for your review.

| Month | Standard-size | Oversize |

|---|---|---|

| January – September | $0.78 per cubic foot | $0.56 per cubic foot |

| October – December | $2.40 per cubic foot | $1.40 per cubic foot |

The size of your products have a dramatic effect on Amazon’s storage fees. In general, oversized items will cost you a significantly higher amount for Amazon to store in their warehouse.

Long Terms Storage Fees

Amazon charges between $.50 per cubic foot to $6.90 per cubic foot in long term storage fees depending on the age of your products in inventory.

If you store inventory at Amazon for longer than 180 days, you will get charged a large sum of money.

Long term storage penalties are calculated by the cubic foot. In general, your Amazon long term storage fee is $6.90 per cubit foot or $.15 per unit, whichever is greater. Long term storage fees are assessed on the 15th of each month.

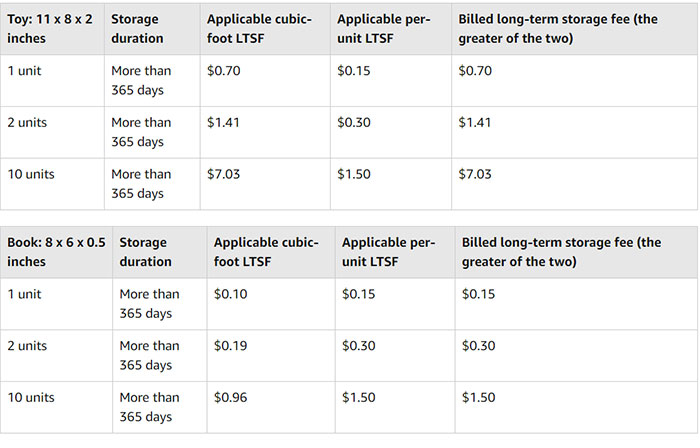

Here’s a table of long term storage fees.

| Inventory assessment date | Items aged 181-210 days | Items aged 211-240 days | Items aged 241-270 days | Items aged 271-300 days | Items aged 301-330 days | Items aged 331-365 days | Items aged 365 days or more |

|---|---|---|---|---|---|---|---|

| Monthly (15th of every month) | $0.50 per cubic foot (excluding certain items)* | $1.00 per cubic foot (excluding certain items)* | $1.50 per cubic foot (excluding certain items)* | $3.80 per cubic foot | $4.00 per cubic foot | $4.20 per cubic foot | $6.90 per cubic foot or $0.15 per unit, whichever is greater |

| Inventory assessment date | Items aged 181-210 days | Items aged 211-240 days | Items aged 241-270 days | Items aged 271-300 days | Items aged 301-330 days | Items aged 331-365 days | Items aged 365 days or more |

|---|---|---|---|---|---|---|---|

| Monthly (15th of every month) | $0.50 per cubic foot (excluding certain items)* | $1.00 per cubic foot (excluding certain items)* | $1.50 per cubic foot (excluding certain items)* | $5.45 per cubic foot | $5.70 per cubic foot | $5.90 per cubic foot | $6.90 per cubic foot or $0.15 per unit, whichever is greater |

Here are some examples with numbers to show you how high these fees can get!

Overall, it’s in your best interests to store no more than 12 months worth of inventory and use LTL shipping to Amazon’s warehouse to save money.

Low Level Inventory Fee

Amazon charges between $.32 to $1.11 in low inventory placement fees if you do not maintain a certain inventory threshold in Amazon’s fulfillment centers. This fee goes into effect April 1, 2024.

This low-inventory-level fee will only applies if a product’s inventory levels dip below 28 days based on historical demand. In order for the fee to apply, the long-term historical days of supply (last 90 days) and short-term historical days of supply (last 30 days) must be below 28 days (4 weeks).

Here’s a table that enumerates the fees.

| 2024 size tier | Shipping weight | 0-14 historical days of supply | 14-21 historical days of supply | 21-28 historical days of supply |

|---|---|---|---|---|

| Small standard | Up to 16 oz | $0.89 | $0.63 | $0.32 |

| Large standard | Up to 3 lb | $0.97 | $0.70 | $0.36 |

| 3+ lb to 20 lb | $1.11 | $0.87 | $0.47 |

Amazon FBA Fulfillment Fees

Amazon charges an FBA fulfillment fee of between $3.06 – $6.92 for a standard size package and between $9.73 – $194.95 for an oversized package.

On average, you can expect to pay between 10-15% of your revenue in fulfillment fees for a standard sized product.

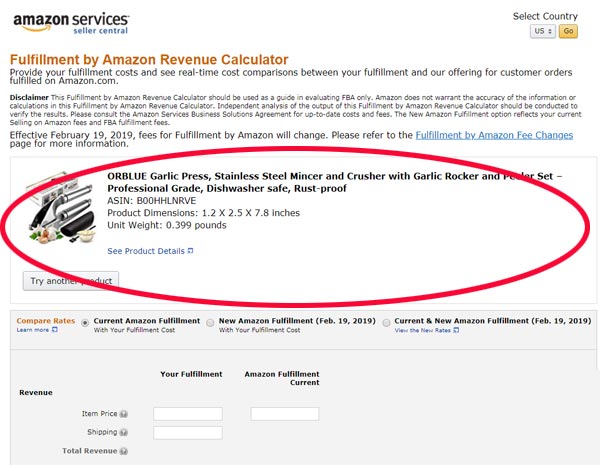

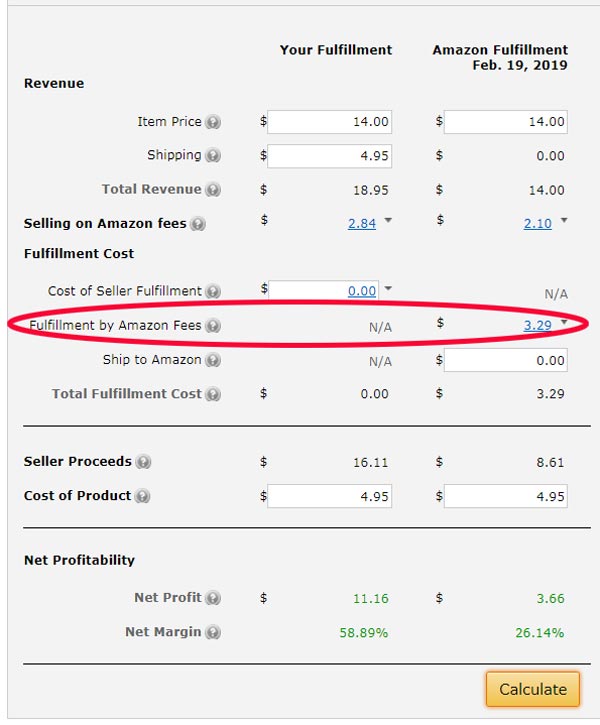

To calculate the exact “Fulfillment By Amazon” FBA fee, Amazon provides a handy FBA calculator which can be found here

To use the calculator, you must first do a search on Amazon and find an item that closely resembles what you are trying to sell.

Amazon will then use the dimensions and weight of this item to help calculate your Amazon fulfillment costs.

Here’s the FBA calculator in action using a garlic press as an example.

Once you’ve chosen a similar item, enter in your selling price and product costs and hit calculate.

Amazon’s fba calculator will then output the approximate cost of fulfillment by Amazon including the pack fee, monthly storage fee and the shipping price.

While this FBA calculator is simple and easy to use, it is by no means 100% accurate. In fact, Amazon full on discloses that the calculator is there for approximation purposes only!

In reality, there are a number of Amazon fees that you must consider that are NOT accounted for with this calculator.

Below is a table that enumerates your exact Amazon FBA fulfillment costs based on size and weight.

| Size Tier | Shipping Weight | Feb 5 to April 14, 2024 | Starting April 15, 2024 |

|---|---|---|---|

| Small standard | 2 oz or less | $3.22 | $3.06 |

| 2+ to 4 oz | $3.31 | $3.15 | |

| 4+ to 6 oz | $3.40 | $3.24 | |

| 6+ to 8 oz | $3.49 | $3.33 | |

| 8+ to 10 oz | $3.58 | $3.43 | |

| 10+ to 12 oz | $3.68 | $3.53 | |

| 12+ to 14 oz | $3.77 | $3.60 | |

| 14+ to 16 oz | $3.82 | $3.65 | |

| Large standard | 4 oz or less | $3.86 | $3.68 |

| 4+ to 8 oz | $4.08 | $3.90 | |

| 8+ to 12 oz | $4.32 | $4.15 | |

| 12+ to 16 oz | $4.75 | $4.55 | |

| 1+ to 1.25 lb | $5.19 | $4.99 | |

| 1.25+ to 1.5 lb | $5.57 | $5.37 | |

| 1.5+ to 1.75 lb | $5.75 | $5.52 | |

| 1.75+ to 2 lb | $6.00 | $5.77 | |

| 2+ to 2.25 lb | $6.10 | $5.87 | |

| 2.25+ to 2.5 lb | $6.28 | $6.05 | |

| 2.5+ to 2.75 lb | $6.45 | $6.21 | |

| 2.75+ to 3 lb | $6.86 | $6.62 | |

| 3+ lb to 20 lb | $7.25 + $0.08 per 4 oz interval above first 3 lb | $6.92 + $0.08 per 4 oz interval above first 3 lb | |

| Large bulky | 0 to 50 lb | $9.73 + $0.42/lb interval above first lb | $9.61 + $0.38/lb interval above first lb |

| Extra-large 0 to 50 lb | 0 to 50 lb | $26.33 + $0.38/lb interval above first lb | $26.33 + $0.38/lb interval above first lb |

| Extra-large 50+ to 70 lb | 50+ to 70 lb | $40.12 + $0.75/lb interval above 51 lb | $40.12 + $0.75/lb interval above 51 lb |

| Extra-large 70+ to 150 lb | 70+ to 150 lb | $54.81 + $0.75/lb interval above 71 lb | $54.81 + $0.75/lb interval above 71 lb |

| Extra-large 150+ lb | 150+ lb | $194.95 + $0.19/lb interval above 151 lb | $194.95 + $0.19/lb interval above 151 lb |

In most cases, the extra dimensional fulfillment fees are NOT covered in Amazon’s fee calculator so you have to cross check your package dimensions with the table above to get an accurate cost assessment.

Fulfillment By Amazon Fees For Apparel

Amazon charges an FBA fulfillment fee of between $3.72 – $6.92 for apparel items.

The following table enumerates the exact Amazon seller fees for apparel based on weight.

| Size Tier | Shipping Weight | Feb 5 to April 14, 2024 | Starting April 15, 2024 |

|---|---|---|---|

| Small standard | 4 oz or less | $3.43 | $3.27 |

| 4+ to 8 oz | $3.58 | $3.42 | |

| 8+ to 12 oz | $3.87 | $3.72 | |

| 12+ to 16 oz | $4.15 | $3.98 | |

| Large standard | 4 oz or less | $4.43 | $4.25 |

| 4+ to 8 oz | $4.63 | $4.45 | |

| 8+ to 12 oz | $4.84 | $4.67 | |

| 12+ to 16 oz | $5.32 | $5.12 | |

| 1+ to 1.5 lb | $6.10 | $5.90 | |

| 1.5+ to 2 lb | $6.37 | $6.14 | |

| 2+ to 2.5 lb | $6.83 | $6.60 | |

| 2.5+ to 3 lb | $7.05 | $6.81 | |

| 3+ lb to 20 lb | $7.17 + $0.16 /half-lb above first 3 lb | $6.92 + $0.16 /half-lb above first 3 lb |

Amazon Inbound Placement Fee

Amazon charges an inbound placement fee of between $.21 – $6 per unit for standard and large bulky products to reflect the cost of distributing inventory to multiple fulfillment centers.

This fee is effective March 1, 2024.

The following table enumerates the exact Amazon seller fees for inventory placement.

| Size | Weight | FBA Inbound Placement Services | |

|---|---|---|---|

| Premium service | Discounted service | ||

| Small standard Max 15x12x0.75 inches | 16 oz or less | $0.21-$0.30 | Send to a single location |

| Large standard Max 18x14x8 inches | 12 oz or less | $0.23-$0.34 | Send to multiple locations Receive a discount up to 100% based on number of shipments and inbound locations |

| 12+ oz to 1.5 lb | |||

| 1.5+ lb to 3 lb | |||

| 3+ lb to 20 lb | $0.32-$0.49 | ||

| $0.42-$0.68 | |||

| Size | Weight | FBA Inbound Placement Services | |

|---|---|---|---|

| Premium service | Discounted service | ||

| Large Bulky Size Max 59x33x3 inches | 5 lb or less | $2.16 to $2.67 | Send to multiple locations Receive a discount up to 100% based on number of shipments and inbound locations |

| 5+ lb to 12 lb | $2.55 to $3.15 | ||

| 12+ lb to 28 lb | $3.19 to $3.95 | ||

| 28+ lb to 42 lb | $4.13 to $5.11 | ||

| 42+ to 50 lb | $4.85 to $6.00 | ||

Amazon Removals And Disposals Fee

Amazon charges a removal and disposals fee of between $.32 – $3.50 to destroy or remove your items from inventory.

The table below enumerates the Amazon removals and disposals fees based on weight.

| Before June 1, 2021 | June 1, 2021, and after | ||

|---|---|---|---|

| Size tier | Shipping weight | Removal/disposal fee per unit | Removal/disposal fee per unit |

| Standard-size | 0 to 0.5 lb | $0.25 | $0.32 |

| 0.5+ to 1 lb | $0.30 | $0.35 | |

| 1+ to 2 lb | $0.35 | $0.48 | |

| More than 2 lb | $0.40 + $0.20/lb above first 2 lb | $0.67 + $0.35/lb above first 2 lb | |

| Oversize and special handling items* | 0 to 1 lb | $0.60 | $0.60 |

| 1+ to 2 lb | $0.70 | $0.72 | |

| 2+ to 4 lb | $0.90 | $1.26 | |

| 4+ to 10 lb | $1.45 | $2.32 | |

| More than 10.0 lb | $1.90 + $0.20/lb above first 10 lb | $3.50 + $0.35/lb above first 10 lb | |

Miscellaneous Amazon Selling Fees

Most of the Amazon seller fees discussed above are fairly straightforward and most sellers are able to account for these costs in their calculations.

However, the Amazon fees described below are unexpected costs that most people don’t think about until it’s too late.

Cost #1: Extra Shipping Bulk

Amazon always adds a packing weight of at least .25 lbs depending on the size of your product (Amazon will add up to a 1 lb more if your product is large and falls under the oversized category).

As a result, if your product weighs .76 lbs, Amazon will always round up to over 1 lbs in their shipping price calculations which will increase your shipping cost.

You also have to take into account the dimensional size of your product as well. For example, Amazon charges a lot more money for oversized goods and you have to take this into account in your calculations.

Below is a table of Amazon’s oversized item dimensions for your review. If your packaging is close to the next sized tier, it may make sense to reduce your box size.

Cost #2: Shipping Goods To Amazon’s Warehouse

While most people account for Amazon fulfillment fees, very few new sellers consider the costs of shipping goods to Amazon’s warehouse.

Getting your goods to Amazon can actually be quite expensive!

What makes matters worse is that Amazon often forces you to send your goods to multiple warehouses across the country.

For example, when you create a shipment on Seller Central, Amazon may ask you to ship your goods to California, New York and Texas!

To combat these costs, you want to avoid shipping goods via UPS or other courier services because it’s super expensive.

Instead, you want to ship full containers and LCL freight directly into Amazon or use LTL if you can.

There is one quick tip that I’d like to share that will save you on costs when Amazon asks you to ship to multiple warehouses.

Instead of splitting up your shipment for each warehouse, simply send all of your inventory to a single warehouse in the beginning. Then, once you get your next shipment in, send it to the next warehouse and so on.

In general, Amazon doesn’t care when you ship to all of their warehouses as long as your product eventually reaches each one.

Cost #3: Returns And Damaged Goods

Because Amazon makes it so easy for a customer to make a return, you will experience a much higher return rate selling on Amazon as opposed to your own online store.

For example, our Amazon return rate is easily 3X that of our ecommerce store.

Also, certain product categories on Amazon have a much higher return rate than others. If you sell clothing, you should expect over 20% of your sales to be refunded.

What sucks is that no matter what, you still have to eat the Amazon FBA and referral fee for the sale!

In addition, you may not be able to re-sell the returned items as “new” if the customer opens or tampers with the product before returning it.

One year, an Amazon customer purchased many dozen napkins from us, used them for a party and then returned the soiled napkins for a full refund.

Well guess what? We had to eat the Amazon closing fee, the Amazon FBA fee and the cost of goods since they could not be resold!

As result, if you sell a highly returned product like clothing on Amazon, you must take into account the return rate in your calculations!

As products are returned, you should track each SKU’s return rate and also the writeoffs related to inventory and closing fees.

Cost #4: Advertising And Amazon PPC Ads

Once you list your items on Amazon, they aren’t going to sell on their own. You have to advertise using Amazon PPC!

Editor’s Note: Make sure you check out my guide on How To Run Amazon PPC Sponsored Product Ads – A Step By Step Guide

When you first launch your product, your advertising costs may well exceed all of your revenues!

In the life of your Amazon product, you will be continuously spending money on Amazon PPC, Facebook ads, Google ads and other promotional mechanisms.

As you are calculating your fees, you should allocate at least 20% towards advertising your products for sale.

Here are some other posts that I’ve written on advertising

- Facebook Retargeting – How To Use Dynamic Product Ads To Generate A 12x Return

- How To Advertise On Facebook – Strategies The Pros Use To Generate Sales

- Google Shopping Explained In One Simple Step By Step Guide

Cost #5: Overhead For Running Your Business

When you run any business, there’s going to be some amount of overhead. The good news is that running an ecommerce business carries much lower indirect costs than a brick and mortar store.

The most common overhead associated with an Amazon business are as follows.

- Photography – You will need to take high quality photos of your products which may require the services of a photographer

- Sellers Permit – Because you will need to pay sales tax, you will need to pay for a Sellers Permit in every state where Amazon has a warehouse.

- Product Liability Insurance – While Amazon technically requires product liability insurance to sell in their marketplace, they are not enforcing this just yet. But it’s in your best interests to get insurance to protect yourself in case you get sued.

- Business Structure – To limit your liability, you should form an LLC or corporation.

- Trademarks – Once you start selling, you will want to register your brand which will require a trademark.

- Intermediate Warehouse Costs – Even though you will be using Amazon FBA for fulfillment, you may want to have your goods sent to a processing center to label or to perform quality control for your goods before they are sent to Amazon.

To address the above costs into your calculations, you should add up all of your overhead costs for the past 12 months and divide that sum by the number of units you sold during the same period.

Then factor this number into your overall costs of selling on Amazon.

Cost #6: Amazon Will Screw Up And Cost You Money

The biggest downside to selling on Amazon is that they screw up VERY often and unless you are paying attention, you will lose money.

Below are some costs that 99% of brand new sellers never consider when they start selling on Amazon.

Note: I classify these “hidden expenses” under the cost of doing business on Amazon.

Because it’s so easy for a customer to make a return on Amazon, you will receive a bunch of them during your lifetime as an Amazon seller.

The problem is that when a customer returns one of your products to Amazon, Amazon immediately refunds the customer but sometimes they forget to pay you back!

Unfortunately, this happens all the time and you really have to keep track of your finances or use a 3rd party service to discover when this happens and recover your money.

The other thing that sucks about selling on Amazon FBA is that every now and then Amazon mysteriously loses your shipment.

Sometimes, parts of your shipment get damaged on the way to the Amazon fulfillment center.

Sometimes, Amazon outright loses your products!

Even though Amazon will reimburse you for lost product, you have to be the one to point out a lost shipment because Amazon won’t tell you by default.

One time, Amazon lost several boxes of our goods and we were reimbursed for the inventory. However 3 months later, they finally found our goods and then promptly deducted the reimbursement amount from our account.

Meanwhile, we lost 3 months worth of sales and had nothing to show for it!

Overall, you have to watch Amazon like a hawk and you always have to check and double check that the quantity received at Amazon matches the quantity that was sent.

How To Save On Amazon Referral Fees

You can sometimes save money on Amazon referral fees by categorizing your products in a cheaper category. However, this practice is not recommended.

If you categorize your item improperly, you may never ever rank in Amazon search.

For example, if you try to sell designer headphones in the jewelry category, then you will never ever rank for headphones because Amazon does not expect to see “headphones” in the jewelry category.

How To Save On Amazon Fulfillment Costs And Other Fees

The best way to save on your Amazon fulfillment costs is to design your packaging to be well below the oversized item category to avoid paying the extra fees.

Avoid irregular shaped packaging and make sure that you send your product to yourself for inspection before doing a bulk shipment to Amazon’s warehouse to confirm the size and weight.

Then, once you make your first shipment to Amazon, make sure that the dimensions that Amazon measures match up with your own measurements.

Amazon often screws this up and unless you are paying close attention to your Amazon bill, you may not discover that you’ve been incorrectly paying oversized FBA fees until a few months have passed.

In the event that you find a discrepancy, make sure you contact Amazon support immediately and have them re-measure your items BEFORE you start selling them.

How To Save On Amazon Storage Costs

Because Amazon owns the entire fulfillment channel, there’s not much you can do to save on storage costs and you need to use Amazon FBA to get the “Prime” label.

Note: You can still get the Amazon Prime label for your product through a program called Seller Fulfilled Prime, but you must be extremely careful because there is a high risk of account suspension if you don’t deliver your goods on time.

The best way to save on your storage costs is to accurately predict your inventory levels and make sure that you aren’t storing too much product at any given time, especially during the holidays.

Is Amazon FBA Worth It?

Selling on Amazon FBA is 100% worth it because of the Prime badge. You can’t beat free 2 day shipping and it’s a huge value add for customers.

But in terms of fees, Amazon FBA tends to be more expensive than most 3PLs.

For example, Whiplash Merch charges only a $.45 per cubic foot storage fee compared to Amazon’s $.68 per cubic foot (and $2.40 from Oct-Dec). The costs do not rise over the holidays either.

As you use the Amazon fee calculator, make sure you compare the numbers to a traditional 3PL to see if it makes sense to keep your inventory there and send your goods to Amazon in smaller batches.

Do You Know Your True Net Profit?

As you can tell from this post, there are many factors involved in calculating your true Amazon fees.

And one of the most important tasks to get right is to figure out your true net profit after all expenses.

Make sure you do your analysis BEFORE you start sourcing products to sell and BEFORE you create an Amazon listing.

Remember, most Amazon sellers are losing money because they don’t take into account the hidden costs.

Overall, the most common ways to save money on Amazon fees are to do your homework upfront and try to prevent yourself from storing too much product in Amazon’s warehouse at any time.

Good luck!

Frequently Asked Questions About Amazon Fulfillment Costs

It depends on which selling plan you choose. Serious sellers pay $39.99/month as a professional seller. For a typical sale, Amazon will take a 15% cut of your revenue. If you are using FBA, Amazon will generally take another 10-15% depending on the size and weight of your item. All told, Amazon roughly takes a third of your sales in fees. For a personal seller account, there is no monthly fee. However, you will pay a $1.00 flat fee on all Amazon FBA products that are sold. Otherwise, a professional seller account costs $39.99. If you sell more than 40 items per month, a professional seller account is worth it. The commission varies widely by category. But in general, expect to pay 15% Ebay charges a 10% commission whereas Amazon charges 15%. However, if you take into account Paypal fees which are 2.9%, it ends up being fairly close. All told selling on Ebay is cheaper. The biggest cost of Amazon FBA is storage and the cost of getting product to Amazon's warehouse. Ideally, you should ship your goods direct to Amazon from your supplier and try not to keep too much inventory on hand. There are no minimums to sell on Amazon. As a result, you can start selling with just a few units of product. With a personal seller account, there are no monthly fees either. From January to September, the fees are $.75 per cubic foot. But this increases to $2.40 per cubic foot from October to December. For oversized items, it costs $.48 per cubic foot and increases to $1.20 from October to December.How Much Are Amazon Fees?

How Much Is Amazon FBA Per Month?

What Is Amazon's Commission?

Is It Cheaper To Sell On Amazon Or Ebay?

How Do I Reduce Amazon Fees?

How Much Does It Cost To Start Amazon FBA?

How Much Are Amazon Storage Fees?

Ready To Get Serious About Starting An Online Business?

If you are really considering starting your own online business, then you have to check out my free mini course on How To Create A Niche Online Store In 5 Easy Steps.

In this 6 day mini course, I reveal the steps that my wife and I took to earn 100 thousand dollars in the span of just a year. Best of all, it's free and you'll receive weekly ecommerce tips and strategies!

Related Posts In Getting Started On Amazon

- Amazon Transparency Program – The Ultimate Guide

- What Is UPC And Where To Buy Cheap UPC Codes For Amazon

- Amazon Brand Registry And The Best Way To Prevent IP Theft

- Shipping Marks: A Guide To Marking And Labeling Shipments

- Amazon FBA Seller Fees Explained & The Costs To Sell On Amazon

Steve Chou is a highly recognized influencer in the ecommerce space and has taught thousands of students how to effectively sell physical products online over at ProfitableOnlineStore.com.

His blog, MyWifeQuitHerJob.com, has been featured in Forbes, Inc, The New York Times, Entrepreneur and MSNBC.

He's also a contributing author for BigCommerce, Klaviyo, ManyChat, Printful, Privy, CXL, Ecommerce Fuel, GlockApps, Privy, Social Media Examiner, Web Designer Depot, Sumo and other leading business publications.

In addition, he runs a popular ecommerce podcast, My Wife Quit Her Job, which is a top 25 marketing show on all of Apple Podcasts.

To stay up to date with all of the latest ecommerce trends, Steve runs a 7 figure ecommerce store, BumblebeeLinens.com, with his wife and puts on an annual ecommerce conference called The Sellers Summit.

Steve carries both a bachelors and a masters degree in electrical engineering from Stanford University. Despite majoring in electrical engineering, he spent a good portion of his graduate education studying entrepreneurship and the mechanics of running small businesses.

Amazing Article to calculate FBA, I enjoyed reading most helpful thank you i check the best answer long time. – AMZ Researcher