Podcast: Download (Duration: 50:06 — 57.6MB)

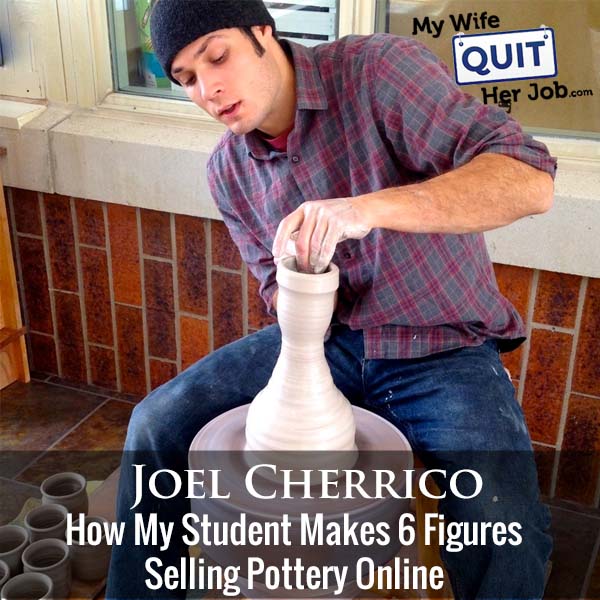

Today I’m really happy to have Joel Cherrico on the show. Not only was Joel a student in my Create A Profitable Online Store Course but he might have been student number 1.

Joel is a potter and he hand creates amazing ceramics of which I have several pieces in my living room. As you know, selling art is probably one of the most difficult products to sell online because you have to create a following in order to command premium pricing.

In this episode, we delve deeply into his story to discover how he turned his art into a thriving business.

What You’ll Learn

- How Joel got started making pottery

- How Joel can charge $500 per mug that he sells online

- How to become famous

- How to build a following of super fans

Other Resources And Books

Sponsors

Postscript.io – Postscript.io is the SMS marketing platform that I personally use for my ecommerce store. Postscript specializes in ecommerce and is by far the simplest and easiest text message marketing platform that I’ve used and it’s reasonably priced. Click here and try Postscript for FREE.

Klaviyo.com – Klaviyo is the email marketing platform that I personally use for my ecommerce store. Created specifically for ecommerce, it is the best email marketing provider that I’ve used to date. Click here and try Klaviyo for FREE.

EmergeCounsel.com – EmergeCounsel is the service I use for trademarks and to get advice on any issue related to intellectual property protection. Click here and get $100 OFF by mentioning the My Wife Quit Her Job podcast.

Transcript

But before we begin I want to thank PostScript for sponsoring this episode. Now if you run an e-commerce business of any kind, you know how important it is to own your customer contact list. And this is why I’m focusing a significant amount of my efforts on SMS marketing. I sincerely believe that SMS or text message marketing is going to be a huge channel for my store going forward and I have chosen PostScript.io to be my text provider. Now why PostScript? it’s because they specialize in e-commerce stores and e-commerce is their primary focus and not only is it easy to use but you can quickly segment your audience based on your exact sales data and implement automated flows like an abandoned cart at the push of a button. Not only that it’s priceable too and you only pay for the messages that you actually send. So head on over to PostScript.io/Steve and try it for free. That’s postscript.io/Steve.

I also want to thank Klaviyo for sponsoring this episode. Now, it’s safe to say that most of us have been doing more online shopping lately. And if you’re an e-commerce brand, that means you might be seeing more first time customers, but once they made that first purchase, how do you keep them coming back? Well, that’s What Klaviyo is for. Klaviyo is the ultimate email and SMS marketing platform for e-commerce Brands. It gives you the tools to build your contact list. Send memorable emails automate key messages and more a lot more and that’s why more than 30,000 e-commerce Brands like Chubbies Brooklyn and Livingproof use Klaviyo to build a loyal following. Strong customer relationships mean more repeat sales enthusiastic word of mouth and less depending on third-party ads. So whether you’re launching a new business or taking your brand to the next level Klaviyo can help you grow faster and it is free to get started. Visit Klaviyo.com/mywife to create a free account. That’s Klaviyo.com/mywife. Now on to the show.

Intro: Welcome to the My Wife Quit Her Job Podcast. We will teach you how to create a business that suits your lifestyle. So you can spend more time with your family and focus on doing the things that you love. Here’s your host Steve Chou.

Steve: Welcome to My Wife Quit Her Job Podcast today, I’m really happy to have Joel Cherrico on the show. Now Not only was Joel a student in my create a profitable online store course, but I believe that he was actually student number one or two way back in 2011. In fact, he signed up for the $99 package. The course is a cost 1,700 bucks and that $99 package didn’t include videos or live office hours. There was a it was a no support tier basically but it didn’t last long and so I ended up Upgrading him soon after to the full package.

Anyway, Joel is a Potter and he makes his own amazing Pottery of which I have actually several pieces in my own living room. And as you all know selling art is probably one of the most difficult products to sell online because you have to create a following people buy your products because of you and over the years Joel has created an amazing audience and has done very well. So today we are going to delve deeply into this story and find out exactly how he did it and with that welcome to show Joel. How you doing, man?

Joel: I’m doing great. You know, thanks. Thanks for bringing me on Steve because we go way back. So I really appreciate all your enthusiasm over the years and I think I actually paid, I was going to pay a little more for that course, but your wife talked you into a discount so you’ll have to thank her for me.

Steve: Yeah, when I launched it was only I think was $99 to the cheapest one and it was $299 for the most expensive one.

Joel: Yeah, I think I’m ready to do some pottery or something for you.

Steve: I think so. I think that’s what it was because at the time you had no money at all if I recall.

Joel: yeah. Oh, yeah for a few years. I was I was really bootstrapped. I was I was basically just living as a not quite a starving artist because I traded a lot of pottery for food, but it was it was tough for a couple of years while I really refined my craft and more importantly when it comes to the internet figuring out proper how to be a proper business person online with art. That’s a that’s a unique challenge so it took a few years, but it’s going pretty well now.

Stwvw: So how did you get started with pottery and what made you decide to start like an online business selling it?

Joel: well When I was 18 for whatever reason I got to college and I was pre-med and I had all these big dreams of becoming a doctor but there’s one problem. I was getting terrible grades in my biology, chemistry. I was getting D’s and F’s and I just hated it too. It’s really struggling and I had taken some pottery in high school. I made about a hundred pieces of pottery and I won an award from for my high school graduating class for pottery. So I knew I was pretty good at it. But I was like, haha how am I going to make a living doing this but for whatever reason I decided that I was going to switch to Art.

So I studied art for four years and right away. I decided I wanted to figure out how to make a living as a Potter. I knew some people did this and it there was you know, people were College professors some people sold Pottery. So I spent four years in college treating that like a pottery apprenticeship really intense working as much as I could. Just trying to get out of all my classes and be on the pottery wheel to refine the craft. With my senior year I knew I had to make a living somehow. So I took some business classes and noticed really quickly the unlimited potential of the internet and reaching people globally and trying to figure out how to pack and ship something fragile took another few years, but it’s been about 15 years of trying to do Pottery full-time.

About 10 years as an actual LLC business and it’s finally started to take off a few years ago some major things happened. And now it’s a prospering business with some employees and we’re looking to expand into a lot of different Avenues.

Steve: That’s awesome. And I have to thank your dad for introducing us. How the heck did he find me actually was it random?

Joel: It was it was probably Google searching. He’s probably just worried about his artist son.

Steve: Yeah

Joel: You know, I give him a business plan. That was I don’t know 90 pages long and rambling about all these ways to make money and he probably was just trying. He’s probably just trying to do the same himself and I’m pretty sure he found you Google searching somehow.

Steve: Yeah, I mean you got cool parents to to be so supportive of your business, you know, I got to hand it to them, hand it to your parents.

Joel: Yeah. My mom was always big in the music people always ask me if my parents did pottery and none they never did. I mean, my mom was a nurse but loved supporting trying to get us into into the Arts and Music and I want a lot of awards and trumpet early on which people Really know about but I had a lot of skill and it’s strange that that transferred into a different art form completely and my dad was he worked for IBM is whole life. So for them to be supportive in something like Pottery, I think they knew that because I’d had so many successes and awards that it was something real.

It wasn’t it wasn’t something that I was just wanted to do only because I was passionate about it. There was a real purpose there and that finally started to it took a few years there were some rough years. But it’s been prosperous long term.

Steve: So how did you know that you could actually make a business out of this where there are other with there a bunch of Potters that you kind of looked up to that we’re making a full-time living doing this?

Joel: you know, it’s rare it’s rare, but I pieced together some of the best parts that I saw from not, First It was Potters but later it was other entrepreneurs when I started actually reading business books right around the time that I took your course and the year or two after that, so It was it was one Potter who I saw she had some mugs on her website and they were eighty two dollars each and I remember thinking man a coffee mug for $82 that seems like I knew I could make a lot of coffee mugs. Like I can hand craft a lot of these things and I just I wanted to bridge that gap of finding out how someone her name is Ayumi Horry and she’s still

Steve: That sounds familiar. I remember looking at her website, yeah

Joel: I probably was just obsessed with her back then and I’ve reached out to her a little bit and she’s a she’s a professional in our field but I saw those her pot sell immediately when she would send a simple email to her mailing list a couple years later after I’ve read a lot of business books. I tried to I was inspired by Tim Ferriss his real world MBA and tried to give myself enough knowledge that it would be like if I had gone to business grad school. So he says something in one of his books that great marketing works the first time and that’s really what I saw in Ayumi’s work it was.

Not just I mean it’s marketing you could call it that but if something more it was a way it was a key to something that could be a livelihood.

Steve: So how did you get your name out there? Because I know that you sell out every time now to and I’m actually on your email list. Yeah, thank you for initial strategy for just building awareness. I guess for what you do?

Joel: Well, I tried a lot of different things and honestly, I sold mostly locally for the first few years and I needed that time to to see how people reacted to the work in person. Most importantly I would throw pots in front of people. I demonstrate my craft. So when Facebook live was created when Periscope was created and even YouTube you can live stream that wasn’t around in 2010. So these when these Technologies happened I had the skills to translate that on the internet. I I now have a film studio. It’s a space we devote only to basically me performing Pottery throwing demonstrations on video.

Combine that with the fact that it’s live and that now we have all these Tools mailing lists giveaway software. All these ways to reach people are our email list is tens of thousands of people now, so the tools on the internet. Just yesterday, there were a few thousand people in my studio that could never happen in person, but thanks to a simple video. There can be a hundred people in my studio at a single time and that really does translate into a lot more people wanting to buy your art.

Steve: So walk us through the process here. So up until those Technologies you were just kind of doing local throwing and maybe Live Throwing and getting some business that way but once these live Technologies came out, can you walk me through how you got started there?

Joel: Yeah, it’s pretty simple. I just opened it. I bought a smartphone and I downloaded Periscope and I put it I put it on a tripod and I just clicked live and I literally just I started one fan at a time. We all start with 0 followers. When the mailing list started. I think when I was taking your course, it was three or four hundred people and I literally just I started slowly and steadily and I explored every online tool available every option one of the Biggest influences on my on the tools I use is an author named Ryan Holiday. Are you familiar with Ryan

Steve: Yeah, of course. Of course. Yeah.

Joel: So I’ve read all his books. I’ve met him a couple times. He actually owns few pieces of my Arts. So he’s got one on his kitchen table which kind of blew my mind because it’s a kind of a big piece and though the first book he wrote it start. It’s it’s it’s an easy read as short. It’s quick and it’s all about getting started short and quick and start with a mailing list of 300 people who who you know, and I’ve learned that the best way to promote your work is often a give it away for free. So through giveaways through a free email newsletter when you’re making a type of especially coffee mug, most of what I do is coffee mugs. That’s just beautiful and people really connect with it.

I mean, that’s how I’ve connected with people like Ryan and Tim Ferriss. He owns a couple pieces. It’s not because they bought my work it’s because I mailed it off to them for free. There’s Is a huge piece of Mind in Neil deGrasse Tyson’s office right now because

Steve: That’s awesome.

Joel: I mailed stuff off to him for free and that developed into a business relationship.

Steve: I know you got mentioned on the Tim Ferriss podcast was that after you gave him one of them?

Joel: So I basically, Yeah. I asked if I could send him some things the cosmic mug was inspired by his Muse concept combining that with the he has a concept called The Muse in the 4-Hour workweek his first book. That’s that’s what bird the cosmic mug, so he He has the one of the very first ones that popped up and I’ve been in in contact with his assistants numerous assistance over the years and we’ve never decided on any kind of collaboration really but it’s you know, he just interviewed Neil deGrasse Tyson like a month ago. So it’s amazing that you start to see these connections and it’s really just putting pieces of the puzzle together.

Steve: Where would you say was like the inflection point like you’re grinding you’re grinding you’re building up your scriber list one subscribe to a time. What was the Tipping Point?

Joel: You know, it’s funny you say that because in 2015, I was I read that book two or three times by Malcolm Gladwell Tipping Point. I was obsessed with it and I can think of a few a few times when that lime light comes on you and then and then it goes away. So one major one was when I decided to turn the cosmic mug into a Kickstarter because that was the best tool at the time. For for putting it out into the world. So in one month this one type of coffee mug raised I we had $25,000 goal and it raised $34,000 and we shipped them to 16 different countries. So that was a nice success and validated the idea. It wasn’t massive but it was it was enough to say okay. There’s really something here and then a couple months later.

Steve: How did you market the Kickstarter because you have to kind of see it yourself with your own audience

Joel: Totally. Totally it was a building it. I spent about a year researching taking that Muse concept from the 4-Hour workweek and researching Kickstarter projects. I took another course actually. It’s by his name is Klay Abear and he studied with Seth

Steve: I know Klay abear. Yeah

Joel: That’s awesome.

Steve: Yeah, we’re going to Mastermind together. I love that guy, yeah.

Joel: Yeah. Well, so I’ll so after I studied with you. I basically studied with Klay specific to Kickstarter and that investment paid off obviously. So so the the kickstarter was a yeah, I it was a slow building I was Klay was big on build your list. So I was building the list by giving away free Cosmic mugs and letting people sign up for free when they wanted the chant when they wanted one to buy. So the kickstarter was a chance for them to get one at a discounts as their high-end mugs are kind of expensive and

Steve: How did you and more to just continue to give him away because shipping is kind of expensive too right?

Joel: Oh, yeah. These are clay, fragile pieces of pottery. If you drop it, it’s going to break. So I was still at farmer’s markets. I was still at art shows grinding it out. That I was still selling a little bit of pottery online and educating my customers on why you know how to how to make it affordable for shipping and why it needs to be a certain price for shipping. I was still figuring that out and I just I just did it. I saw it all is investing in the business. I just that’s the best you can spend $100 on a Facebook ad or you could give away a couple mugs. And I think the value of giving away your art your art what you make if it’s good is always your best marketing.

Steve: So, you had that Kickstarter which was successful and that I imagine built your list even further and then when did The Guinness Book of World Records? When did that fall into place?

Joel: About three months after that? So, I took that the Kickstarter money. I basically… I use that money to figure out the next step. It wasn’t enough to really build a Pottery Studio, you know that 34 thousand dollars sounds like a lot of money in a single month, but I had to create pack and ship a thousand pieces of pottery.

Steve: That’s crazy.

Joel: Yeah costs over 20 grand and I think I pay yourself. So, I was still scraping by, but I decided you know what, I like to. I was single I was just living in a little apartment. I was like, you know what I’m going to keep… I’m going to keep exploring what I want to explore so I had been practicing for the Guinness World Records title for its “Most Pots Thrown in One Hour by an Individual” Throwing pottery means twisting Pottery on a wheel and so I decided I was going to practice and I spent about a year practicing but after the Kickstarter I spent… I took a whole month and I was like I was training for a marathon five or six hours a day because I was doing on my kick wheel. There’s another record now, it’s someone else has it but they did it on an electric wheel.

Steve: That’s cheating.

Joel: Yeah, so I was I was kicking the wheel to do it and the previous record holder did a hundred and fifty on an electric wheel and so I hired a couple students to film the whole thing, and I did it on public space and I got it on my first try I made a hundred and fifty-nine. So, I beat it in an hour and you can find that on YouTube. It’s pretty cool to watch.

Steve: You probably have to be in shape to do that to right? For an hour like physically in shape?

Joel: It was excruciating. Yeah. I was just dripping sweat and is one pot every 24 seconds for an hour straight. I had no idea if I could do it so that that was the first kind of made that was a Tipping Point. You could say it was a nice piece of publicity Guinness World Records actually came to the town where I’m at in interviewed me after that, so it had a long effect of nice publicity.

Steve: So did it generate any sales as a result of that or?

Joel: I mean, it’s still generating.

Steve: Oh really okay. Okay

Joel: It’s hard to calculate it’s not something that it that’s trackable like a Facebook ad. But but it’s I mean the fact that we’re talking about it right now means it was a milestone that was really important for showing me what’s possible. Well with zero budget.

Steve: Okay. Okay. And so you got in the Guinness Book of World Records that sent you some some traffic, I guess in some sales was that enough to sustain a living at that point?

Joel: still wasn’t, no. No. I was still showing locally. I was probably up to maybe 30 or 40 percent of of my Pottery entering the world through the internet people, you know, people were still kind of The tools may not have been ready or I may not have been ready. But basically once I started to do video and embrace video, especially live streaming video, Facebook live, Periscope when Guinness World Records came, we did a Facebook live video. And so I spent an hour with Guinness World Records with them at they had the microphone and I was throwing Pottery talking about the record and 300,000 people watched that

Steve: Oh three hundred thousand. Wow

Joel: Yeah more than that and then I Videos on my own and a couple of them were watched by over a million people.

Steve: Wow. Okay. This is like Facebook live or what is this?

Joel: It was all Facebook live, Periscope didn’t have nearly as high of a reach for whatever reason my fans want to hang out on Facebook.

Steve: And so I’m sorry you had a million people live?

Joel: Numerous times. I’ve had a couple million when I’ve livestream on what I do is I’d live stream on other pages on Facebook that this kind of hippie Pages once called expanded Consciousness and two million people watched me in an evening throw pottery and then I would just do it on my own my CherricoPottery page and 200,000 would watch.

Steve: Wow!

Joel: I think that was something when it was new there’s we were obsessed with the new because now I do I do a scheduled video schedule about 10 every single month and they’re watched by an average of five to ten thousand people each so it goes up and down.

Steve: No, but I mean that’s still a lot. So when you do it on someone else’s page, Imagine you have to ask for permission and everything, right?

Joel: Yeah. I connected with those pages the same way. I connected with Neil deGrasse Tyson and Tim Ferriss initially. I just messaged them or email them or said hey, would you like a free piece of pottery or with throwing this Pottery serve your fans? I think, you know people seem to like it maybe they would like to see it and they would just say sure and I would live stream for a couple hours. I would try to be professional. I ended up building a professional live streaming Studio, which is pretty simple it’s just a pottery wheel with a curtain in the background, space technology.

Steve: Right. Right. So when you get all those people like a couple million people watching you live. I imagine you just your sales go Bonkers, right?

Joel: So the biggest difference between all of your fans who are listening and what I do is most businesses have a scalable product in quantity. I knew from day one that my hands can only make so many pots and sure I can hire a bunch of potters and I still might but that’s not why people want to support the art. That’s not why they’re part of this journey and following my story. It’s because they want to connect with an artist and they want to connect with something that I’ve crafted. So what I did was I made more intricate art. I made more valuable art.

I made one offs that were more rare and then a grouping of a hundred that are simpler. So I’ll have a $50 mug and I would have a $500 mug and that’s how it works to this day.

Steve: I see and so do you make any of the less expensive mugs anymore or

Joel: oh, yeah, but they they don’t stay in stock. So that the problem is they sell out especially with it’s a mug with a handle because I make plates, bowls, all kinds of things but there’s something magical about a mug and I can’t keep them in stock for 50 or 60 or $70. So are five hundred dollar ones. I’ve got a lot of those in stock right now and then Two to three hundred dollar ones fewer of those and anything below $100 tends to sell too quickly for me to keep it in stock. And that’s been sustainable for now. I want to offer lower-priced things, but I’ve got a few challenges to figure out before we’re able to do that.

Steve: Yeah, but if your hand making everything I can imagine that price point being worth it.

Joel: It’s not responsible for an artist to have really low prices and struggle to make a living.

Steve: Yeah

Joel: I did that man. I spent five years doing that after college. So I tried and I loved it while I was doing it that time is over and at some point if you’re going to make a living as an artist, you need to raise the quality of your work and then raise your prices and take the criticism that’s going to come with.

Steve: Does that mean that every single one of your pieces is completely unique every time you make it?

Joel: Yep. Yep. There’s it’s impossible for them to be identical which is part of the magic of clay.

Steve: If you sell an Amazon or run any online business for that matter, you’re going to need a trademark to protect your intellectual property. Not only that but a trademark is absolutely necessary to register your brand on Amazon. Now, I used to think that any old trademark registration service would work and that could even try to register my own trademark by myself on the cheap, but I was dead wrong. Securing a trademark without a strategy in place usually results in either an outright rejection or a worthless unenforceable trademark. Now, that is why I work with Stephen Wiegler and his team from Emerge counsel. They have a package service called total TM, which provides the same attention to detail and process that large law firms do at a fraction of the price. Now for me personally, I like Emerge Council because of their philosophy, their goal is to maximize IP protection while minimizing the price. So before you decide to register a trademark by yourself or file for other I could protection such as a copyright or a patent, check out Emerge counsel first and get a free consult. For more information go to emergecouncil.com and click on the Amazon sellers button and tell Steve that Steve sent you to receive a $100 discount on the total TM package for Amazon sellers. Once again, that’s emergecounsel.com over at emergecounsel.com. Now back to the show.

Steve: So when you want to do one of those lives, I would imagine even the more expensive pieces sell out right when you have that many people on?

Joel: So so that was happening back when you write when Guinness World Records happened and I was getting millions and millions of views. That’s what was happening. So what I did was I it was gut wrenching at first, but I raised all my prices and then I raised him again and then I raised him again. So the $25 mug went to 45 and I added a layer of glaze Is then I went to 85 then it went to a hundred and twenty-five for a coffee mug and I added multiple layers of glaze with brighter colors and I tried to communicate that intricacy. So the ones that are $500 if they take ten times as long to make than a $50 mug. That’s why they’re worth the price.

Steve: I see did people Flinch when that happen when you started raising prices?

Joel: People will still Flinch, two things happens people got really upset and flinched and the mug sold out.

Steve: Yeah, so would you say that those aren’t your Target customers in the first place? Then? I mean your true fans are the ones that are willing to pay the price for Quality.

Joel: Yeah, I wrote an article for the American craft Council called the search for 1,000 true fans and it was inspired by this article by Kevin Kelly. It was a one of the founders of Wired Magazine. Have you heard of this article before?

Steve: I haven’t read the article, but I mean a thousand true fans. That’s a well-known. Yeah.

Joel: Yeah, and so the idea is if you can sell a product for $100 and I know these coffee mugs $100 per mug this was this was largely inspired by me my own selfish. How do I how can I do this? How can I make a living? So I’m kind of forgetting your question. I’m not hoping I rambling here.

Steve: No, no, no. It’s just basically when you raise your prices people flinched and then I started talking about. Hey, those weren’t your true customers or your true fans.

Joel: Okay, that’s yeah. Yeah, yeah, so they I want to I need to give them a chance to be because some people are on fixed income. It’s when people watch these Facebook live videos, I get the I get feedback that it feels like what Mr. Rogers got on public television. It feels like what Bob Ross and The Joy of Painting these Public Television TV shows that’s our social media now people say your videos are theraputic. I have PTSD in this has helped me through so many dark times, you know, I poured my heart and soul into these things for two hours straight.

I’m throwing Pottery. So if they can’t afford a mug for more than $30, I’m trying I need to meet them where they’re at because that’s the bulk of the people to so I try to understand try to see that the frustration is largely coming from they want to be a true fan and the vast majority of people can’t afford that which is why which is why I added a lot more ways to you know, we have a subscription model now for five dollars and nine dollars a month and I’m also adding some lower end products

Steve: interesting. What do you what do you get for that subscription?

Joel: So there’s there’s a I think just over 400 people now on patreon who are supporting us at $5 a month, nine dollars a month, and $24 a month.

Steve: Do you put out bonus content for these folks?

Joel: it started that way and it’s evolved into basically a pottery Option so at $24 a month, they get a moon mug that’s worth $500. And I also send them a cosmic mug and a cup and an educational brochure pack and they do get bonus content. So

Steve: so that sounds like a great deal.

Joel: Yeah, so that’s that’s what subscription models are tough. Right? So yeah, that’s it needed to be. So you know.

Steve: so you’re limited obviously by the number of pieces that you can make in any given month and so these subscription Has that you’re talking about wouldn’t it be and I guess maybe money isn’t the primary motivation for everything but wouldn’t it be more economical or useful for your time to just produce the higher end mugs and maybe a smaller quantity of the loan ones. It seems like you are at $25 a month and you’re giving away a $500 mug. It seems like a huge bargain. Right?

Joel: Well, yeah, it takes them a year to get that so they have to stay committed. So there’s a lot of trust on them to every month

Steve: I see.

Joel: Until they get that mug stay subscribed.

Steve: Got it.

Joel: But also, you know one of the best feelings in the world is when you raise prices on your art and someone believes you and they buy it. One of the worst feelings of world in the world is when you raise prices and you hear crickets and nobody buys it and they’re supportive and so it’s not like it always works. I have I am I mean I have hundreds of thousands of dollars of retail value Potter three-foot jars. I have hundreds of pieces in storage, platters, wall platters jars that don’t sell so it’s important to meet your fans where they are and it’s also why like I said, I’m building a business relationship with Neil deGrasse Tyson because he lives in New York City.

He has his own TV show in National Geographic and New York City’s the art capital of the world. So right now, I’m he gave me some homework to find a gallery to come see the art that he has so we are exploring that high-end that high-end, Ultra high-end Ceramics, and but I’m also planning to travel to China to explore having some products made their.

Steve: let’s talk about that. How would that work? If people are buying these pots because of you then how would this whole Outsourcing to China? It just seems like it would be a huge negative.

Joel: Totally. Yeah. I really I wanted I want to come on this podcast to get your opinion on that Steve because that was the credit. That was the overwhelming feedback. I got when I had some pieces designed and launched them to our fans it started off really negative, but Is a reason that porcelain Ceramics are called Fine China, the Chinese have been doing it for two thousand years and the specific type of pottery I make this black Pottery that’s inspired by outer space. The cosmic mugs. That is a Chinese glaze from about a thousand years ago the Song Dynasty.

So it might not be the best idea to have everything every product you’re doing made in China but something if I were to have these made in Italy made in Germany, The quality would be lower and that it’s the Chinese have they know porcelain. They’re, I think over 700 porcelain factories in China and I’m doing it because I believe that the quality will be highest and that we can figure out how to keep the price low the quality high and have deep respect for Humanity and the environment.

Steve: So for these ones that you are getting from China, do you put your own personal spin on it somehow?

Joel: Well, I’m acting as a designer. So I’m learning I’ve been doing this for less than a year. Next week 400 mugs are coming, so we’ve ordered multiple batches and they’ve all sold out at about 36 dollars each

Steve: Nice.

Joel: Every one. So I’m slowly scaling up. And yeah, it’s a glaze that it’s a shape based on my mug, but it feels it feels remarkably different. You said earlier that you know, everyone is unique because my hand touches it. These ones are all the same the shape is all identical because they’re made with molds. They’re made with porcelain poured into molds their factory made but it’s funny because who works in factories.

I mean, it’s still people is still hundreds of people who are who are handling these pots and there are little smudges. The glaze is remarkably unique. So we developed a glaze that is so complicated that every one of the Chinese mugs is also an individual unique mug because of the glaze not the shape. Does that make sense?

Steve: Yeah, yeah, absolutely. You know, I guess the model that you’re taking is a model that a whole bunch of I guess clothing makers and that sort of thing have taken also, right. They have their own original pieces that they sell for a lot and then they also have you know, mass-produced pieces that they sell at a much cheaper price. I guess the only thing to get over like it would be different is if you had like a team of apprentices who studied under you and we’re producing these pots that I feel like that would be a little bit more meaningful from a customer standpoint. But if what you’re doing is working then that is a way to scale your business.

Joel: Yeah, we were hiring in a month or two. We plan to hire our second full-time employee. My wife and I are the only two full-time employees now, but we could use some help and we’re considering whether it’s going to be an apprenticeship model or something more like, there’s this great book called The e-myth Revisited and Talk about oddly enough. They talk about McDonald’s in that book and it was a it was hard for me to read it first. But I’ve since read at a few different times and it’s like well, yeah, why is why is McDonald’s been around for 50 years and why can any high school kid figure that out.

So we might hire a prentices we might hire just some local workers and some friends high school kids. Yeah, we’re navigating that but I see what you’re saying in terms of the meaningful purchase. I believe I could probably make make I make about three to four thousand pots a year. I can probably push that up to five or six thousand with a little bit of help.

Steve: Yeah, definitely and your wife sounds really understanding as well. So she doesn’t she works full-time in your Pottery business?

Joel: Yeah. She has a graduate degree as a Montessori school teacher and she had she was just finishing that up when we started dating, but she originally studied art we both spent four years of our college education studying art. That’s what we’re passionate about. So when business started to take off and we finally passed that six-figure Mark and then almost doubled our goal and businesses continue to grow. I just I knew I needed to hire so we try to spend every day doing what we want to do making art. A lot of what we do is still the tedious handcraft that we’re plan to hire some help for but her craft is actually making paper by hands not Pottery by trade. So we’ve sold a lot of her paper products now to our fans.

Steve: Interesting. Wow, that’s cool. Joel like I get a lot of people who are artists and they come to me whether and asked me like how do they start an eCommerce store and do essentially what you’ve done. What would be your best advice to these folks?

Joel: Well the art always comes first.

Steve: Okay

Joel: You always have to make the art first and Aesthetics and why you’re making your art and the objects you’re making that’s always most important, but if you can’t figure out the financial and the economics of it then it’s like fuel for a rocket ship. Okay. This isn’t just the this isn’t just the nihilistic pursuit of Rocket Fuel. Okay, but you’re not going to get off the launch pad without it. Like what we want to do is explore, you launch a rocket to go explore because you want to explore what’s out what’s in the far beyond that’s what business is. That’s what a venture is when you’re starting a business.

But Rocket Fuel is essential and money is rocket fuel. And most artists we you know, we all we all assumed that people want to in like they know like what we make but you need to make something people want you to start with a humble mindset that nobody cares, you saw when I was struggling to sell $25 mugs and they would just sit there is no nobody cares. You need to start with a humble mindset and it’s your responsibility to educate and attract people to your story of why what you’re making matters. And if people aren’t attracted to it, then maybe you need to make something else.

Steve: You know, it’s funny. Joel is when you before we actually spoke, I remember looking at your mugs and I was like, okay great. These are nice mugs. I hadn’t seen one. I only saw it on your website, but it was after we had our first Skype chat and just talking to you like your products instantly became like thousands of times more attractive and for you to you know, I what I was thinking you were going to say was put yourself out there and start creating videos. And like get built a following get people attracted to your personality. And then anything that you’ll make will eventually sell. Do you feel that way?

Joel: I feel like that’s a trap. I feel like social media and Trends push us to think that’s most important. But in reality the only type of success and Prestige and money that come are the type that are slow and built over long long periods of time. So I understand that Fame and putting yourself out there that is really important, but that just that was something that not only came natural to me. I actually have a big problem with ego. I tend to just put myself out way too much when I when and when I decided to you know what I’m just gonna let the art speak. I’m going to shut my mouth. I’m going to focus on the Arts.

I suppress my ego as much as I could. I still talk, I love to talk so I still end up talking about it, but the objects themselves became truly remarkable the physical act of making them turned into a Guinness World Record

Steve: Hmm, that is so Interesting

Joel: I think that yes. Isn’t too much. Yeah, too many of us start with I’m afraid to put myself out there when the real problem is. I’m afraid to make something people want.

Steve: Interesting, were there any times when you are tempted to kind of sell out and just because you needed the money and you knew you could make more money by doing things a certain way that you wouldn’t necessarily be your style. Does that make sense?

Joel: Yeah, but I it does but it doesn’t. And what you mean by sell out, like what can you define that you mean by sell out? It’s so it’s tough for me because I this is a question I’ve gotten often from people like you people who are

Steve: I’m not an artist. So yeah

Joel: no no, but your I consider you one of my mentors Steve you were you seen so much my early career and my Pottery Professor. He’s kind of my Mr. Miyagi told me to whack taught me to wax on wax off. I use his pottery wheel. He asked me that once too and I’m not sure if there’s a clear answer to it because when you’re a business person your job is to I mean, 95% of my art enters the world through sales on the Internet. It’s shipped directly to people’s doorsteps, So when we having a low month and I need to lower prices on a $500 Moon mug and sell it for 200 at you know, Black Friday price sales, I do it.

And I’ve always noticed that people are happy to get the discount they understand that sales happen in short periods of times and I’ve just tried to take that take the free-market jungle for what it is that the business is going to tell you what it needs customers are going to tell you what they need and you have to meet them when they where they are if they can’t afford a 200 dollar coffee mug, then sometimes you’re going to have to lower your prices. You can raise your prices and you have to lower your prices sometimes and try to be honest and respectful throughout the entire process.

Steve: I guess I wasn’t talking in terms of pricing. So let’s say your audience wanted a certain type of mug, but that’s not the type of mug that reflects your style. Would you go ahead and make that mug if you need the money, you understand what I’m saying like the customers dictate might not necessarily be your art style.

Joel: Yeah, I see what you’re saying. So everybody wants a mug with their name on it. That’s I get asked that every single video, you know thousands of times so fortunately, I think I’ve creative enough variety Mountain mugs, Moon mugs this Nuka glaze. I have a iron Brown and a cobalt blue and there’s three different styles of moon mugs and a Neptune mug and a spiral Cosmic mug and a lunar I could go on and on so because so I when I asked I answered that question to them with variety, there’s such a variety of a body of work a catalog that I make that I say no to I can say no to a hundred percent of the commission request that come in because I’ve created a more profitable catalog that people like more than some tacky mug with their name carved in the side that they want to pay $20 for.

Steve: Okay.

Joel: Does that make sense?

Steve: Yeah, it does. Yeah. So you mentioned focusing on your art and making the art stand out as a reason to buy it. But even if your artist Superior, it’s not no one’s going to buy it unless they know it’s around right? So it seems like you also need to always put yourself out there in addition to, you know perfecting your art form, right?

Joel: Oh definitely.

Steve: So for someone just starting out. Would you say that building that audience first is what will make the whole art selling experience a lot easier or would you perfect the art and then build the audience?

Joel: Well, I guess I just like to share as much as I can about what I did and what I did was perfect the art first.

Steve: Okay.

Joel: So it was through high school that I made about a hundred pots and then through college I spent four years and I don’t want to say I didn’t sell anything. Because I sold about $5,000 worth of pottery during college at the bus stop. So I was learning how to make things people want and I was putting myself out there performing Pottery demonstrations. I’m so I was doing both but I think if you if you focus too much on creating contents and putting yourself out there. You end up just like everyone else as opposed to with where’s your magic?

What’s special about you and if it is the art if you can make art that’s truly remarkable that I did that to me that feels more powerful in my gut and I feel like if you’re just doing things for clicks for likes for metrics before you perfect something that’s worthy of those clicks and like some metrics then I just didn’t do that. Like I’m not Gary Vee, you know

Steve: Yeah of course.

Joel: I can only I can only talk so much before I have to let the art speak for me

Steve: Right. Okay, cool, Joel. We’ve been chatting for quite a while and I wanted everyone out there listening to get a chance to see your works. So where can people find you, where can they buy your pottery?

Joel: Yeah. Thank you. So, my name is Joel Cherrico and cherricopottery.com. Cherrico is C H E R R I C O —- and if you Google that all kinds of stuff will show up. I make the moon mugs in the cosmic mugs that will probably show up in Google and on Facebook. The best way to watch is really on Facebook because I really like I let you into my studio and we just hang out while I throw Pottery. But yeah, we do we do everything we can to spread the word. We have the mailing list where we give away free Pottery every single month the cosmic mug, cosmicmugs.com is what our bestseller is. It’s what people seem to gravitate towards most. Just so we built a whole website just devoted to that.

Steve: What was the rationale for that?

Joel: You know, it’s funny all these people that I’ve connected with. I’m actually a client of Ryan Holiday and all that means is we had a phone call after I read so many of his books and wrote a blog post about how his work inspired me and we talked for an hour about how to make this profitable because I was really struggling it was post Kickstarter. So there was supposed to Guinness World Records we had evidence that there was something real but I was struggling with sales, online sales and he said why don’t you build Cosmicmugs.com and figure out what does it cost to sell a cosmic mug with a Facebook ad is it $5.00? Is it $10?

Like wouldn’t that just like accomplish all these things you want to do anyway, if you just built a real business instead of chased Fame and New York City and all these things like that stuff can come later. But why don’t you just build a real business in the meantime, so it was a It was hundreds of hours of work through our websites, hiring student workers to help Consulting with some of the best in the world and trial and error lots and lots of trial and error of how to properly serve people with a coffee mug shipping it to their doorstep that they can purchase from anywhere on the planet.

Steve: Why not create a dedicated landing page on Cherrico Pottery?

Joel: So I did a landing page before the kickstarter to collect email addresses, but Right now we’re more focused on sustainable monthly Revenue. So cosmic mugs are available every day. And there are some email signup tools.

Steve: Oh I see. Cool

Joel: We use Bigcommerce still so if people aren’t ready to buy $100 coffee mug, we say go sign up for e-mail newsletter list and you might get a chance you can we give them away every month. So we’ll announce a giveaway and then we can email market. So we send we can email Market to people every month we and if a certain style like a $50 mug is sold out we can just email them and let them know that the less expensive ones are available. So we use Sumo email signup tools and all three of our websites. They all kind of look like one website, but there are three different websites two Big Commerce websites, one WordPress website where two out of the three people can actually purchase through Bigcommerce. And then one is a Blog all of them have email signups. So I didn’t see the need for a landing page now that we have the email signups.

Steve: Oh, I meant instead of starting Cosmic Pottery or Cosmicmugs.com and just use CherricoPottery.

Joel: Yeah. Yeah. It was a hassle to build a second and website, right? That was I’m still trying to understand that strategy myself, but The Branding has raised sales.

Steve: Okay. Yeah, I can imagine if you want higher rank for Cosmic mugs, which is your thing. That would probably be the best way to have like a focus marketing effort if that’s your best seller. Yeah.

Joel: So I know you drove home early on the importance of backlinks the importance of showing up in Google and I still don’t completely understand that but what I do understand is that when you focus whether it’s on marketing or on products or on building traffic that focus is extremely powerful and the cosmic mug is about focusing all of this story into one coffee mug.

Steve: Cool.

Joel: And that’s worked.

Steve: Where can people find you on patreon. And what do you offer on patreon?

Joel: Yeah, everything whether it’s Instagram, patreon all that is CherricoPottery. Patreon, we give you the live video schedule so many People ask when they see me making pottery. They’re like, oh I want to learn to do that. So they asked you to teach classes. Do you let us visit all these things. So I created an educational brochure pack. It’s a bunch of different Flyers essentially, but I catered each one to something specific to the pottery process. So if they join it’s five dollars a month is our lowest tier on patreon and we mail it out right away. So we send it out with a piece of Siena’s paper art. Actually. It’s a lot easier to ship paper than Pottery. Right?

Steve: That’s cool. Yeah

Joel: So, patreon, Chericco Pottery and then at nine dollars a month we give them a discounted deal on the cosmic mug and higher than that’s the moon mug and yeah it’s been growing every month it’s relatively new I think it’s a coming up on the two-year Mark

Steve: Cool awesome, awesome I just wanted to give the audience every possible way to follow you and support you.

Joel: Yeah I appreciate that man you’ve been a big help and I’m really happy that we could connect again it’s been a while.

Steve: It has been a while and I’m really happy that you’re doing so well and it just makes me really just makes me really happy, really.

Joel: Cheers man, well you’ll have to experience the new art so be sure to send me your address when this is done I’d like to mail a

Steve: No, I’ll buy one dude yeah I’ll buy one.

Joel: You can you promise me you’ll buy one but right now we’ll just pretend you want to give away so I like to mail you the first one

Steve: ha ha

Joel: You can give away to your fans or something or you could buy a second one at some point but I appreciate you, your believer early on and you know that’s what an artist needs when they’re starting out.

Steve: Cool, well I appreciate it Joel and thanks a lot for coming on the show.

Hope you enjoyed that episode. Now, for everyone out there who does not believe that artists can thrive in e-commerce. Joel is living proof that it’s possible. He charges over $500 a piece for his works of art. For more information about this episode. Go to mywifequitherjob.com/episode309.

And once again, I want to thank Klaviyo for sponsoring this episode, Klaviyo is my email marketing platform of choice for e-commerce Merchants. You can easily put together automated flows like an abandoned cart sequence, a post purchase flow or win back campaign. Basically, all these sequences that will make you money on autopilot. So head on over to mywifequitherjob.com/klaviyo and try it for free. Once again, that’s mywifequitherjob.com/klaviyo

I also want to thank PostScript.io which is my SMS marketing platform of choice for e-commerce with a few clicks of a button. You can easily segment and send targeted text messages to your client base. SMS is the next big own marketing platform and you can sign up for free over at PostScript.io/Steve. That’s Postscript.io/Steve.

Now I talked about how I use these tools in my blog and if you’re interested in starting your own e-commerce store head on over to mywifequitherjob.com and sign up for my free six day mini-course just type in your email and I’ll send you the course right away. Thanks for listening.

Outro: Thanks for listening to the My Wife Quit Her Job Podcast where we are giving the courage people need to start their own online business. For more information visit Steve’s blog at www.mywifequitherjob.com

I Need Your Help

If you enjoyed listening to this podcast, then please support me with a review on Apple Podcasts. It's easy and takes 1 minute! Just click here to head to Apple Podcasts and leave an honest rating and review of the podcast. Every review helps!

Ready To Get Serious About Starting An Online Business?

If you are really considering starting your own online business, then you have to check out my free mini course on How To Create A Niche Online Store In 5 Easy Steps.

In this 6 day mini course, I reveal the steps that my wife and I took to earn 100 thousand dollars in the span of just a year. Best of all, it's absolutely free!